What is the Best Way to Sell Historic National Gold Bank Notes?

The good news is that your National Gold Bank Note should be worth much more than its face value and it is fortunate that you still have it!

The United States Treasury printed 200,558 National Gold Bank Notes in the 1870’s and 1880’s. The total value of those notes was $3,465,240. Adjusting for inflation, this would be $102,643,153.54 in today’s economy!

Who Issued National Gold Bank Notes?

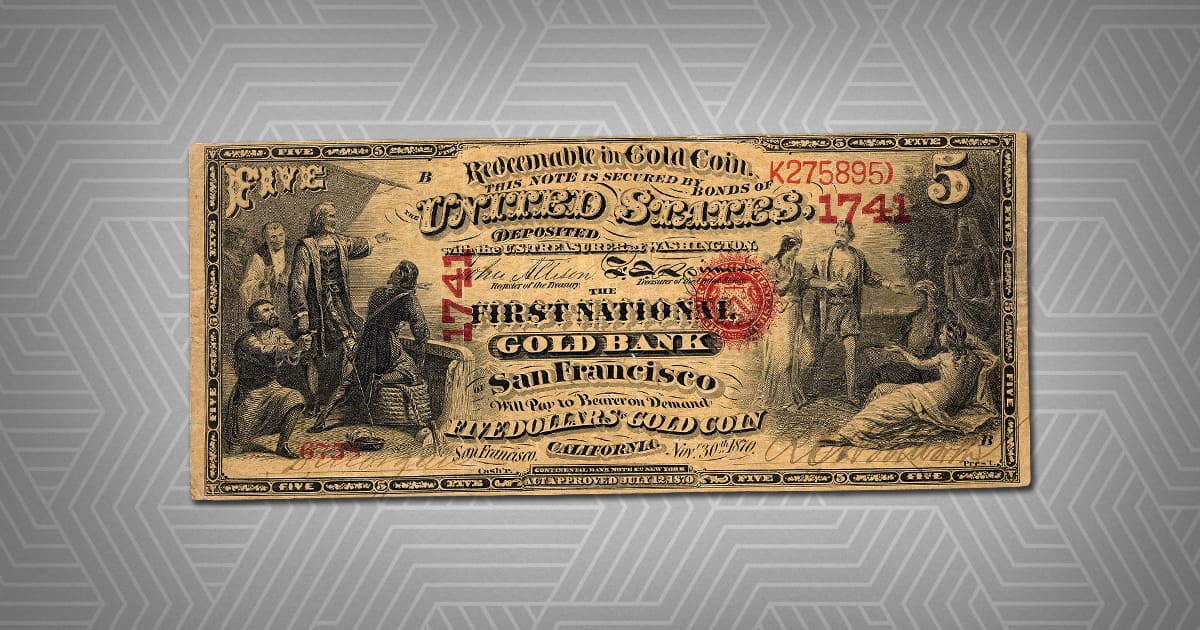

Nine national banks in California and one national bank in Boston issued National Gold Bank Notes from 1871 through 1883. These were printed on yellow paper and redeemable for a designated amount of gold in six denominations from $5 through $500. A $1,000 National Gold Bank Note was printed but never issued to the public.

Today, larger denomination National Gold Bank Notes are a rare find. There are about 630 known National Gold Bank Notes with only twenty of those graded above VF or Very Fine.

Why Can’t I Pay for Dinner with a National Gold Bank Note Today?

The modern banking system does not support the use of Gold Bank Notes. The United States departed from the gold standard in 1933 and today’s U.S. Dollar is backed by the Federal Government instead of a precious metal.

National Gold Bank Notes were widely used in their time but are not used in commerce today. Imagine the surprised look on a cashier’s face if you handed them what was $20 in gold by 1880 standards. That would be about one ounce of gold, which is worth close to $2000 today.

How do I Sell My National Gold Bank Note?

Despite the limitations of using them, your National Gold Bank Note still has value and has magnitudes beyond its face value to the right collector. These notes are a tangible reminder of the growth of American currency, as well as America’s evolving relationship with gold.

To sell your Gold Bank Note, you will want to find a buyer who understands its historic and numismatic value. Start by finding and contacting private collectors online or in collector communities in your region. If you do not find a buyer there, consider either a numismatist or a gold dealer.

Whoever you sell your National Gold Bank Note to, you should be able to make a substantial amount of money if it is in halfway decent condition. It is imperative to beware of scams and frauds when selling valuable historic items. Before selling, it would be wise to have a professional grader examine your note and help you determine a fair price to sell it.