Silver, revered for its beauty and rarity, is a precious metal for collectors and a wise investment choice for those looking to diversify their portfolio. Understanding the basics of investing in silver is crucial for anyone interested in entering the silver market. Silver offers a more affordable alternative to investing in gold while providing many of the same benefits, such as hedging against inflation and offering a tangible asset you can stack.

Is Silver a Good Investment?

Silver is a worthwhile investment for diversifying your portfolio and hedging against inflation. It is lower priced than gold making it more accessible, and its industrial uses ensure ongoing demand. Like any investment, investing in silver comes with risks. We recommend assessing your investment goals and risk tolerance and consulting with a financial advisor before making major purchasing decisions.

Different Forms of Silver Investments

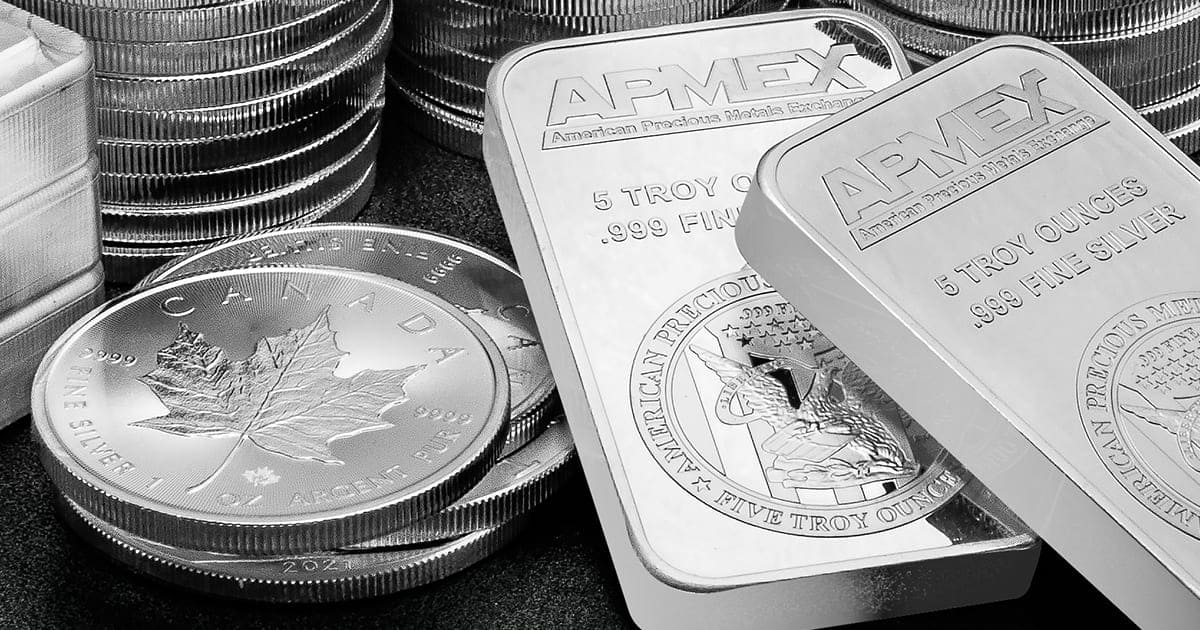

- Bullion Coins, Bars, and Rounds: These are pure forms of silver, valued for their metal content. Silver coins are often part of a collectable series, such as the American Silver Eagles.

- Numismatic Coins: Collectable coins that carry value beyond their metal content, often prized for their rarity, history, and aesthetic appeal.

- Silver ETFs and Stocks: Financial instruments such as silver EFTs offer exposure to silver without the need to physically hold the metal.

- Silver Futures and Options: For more experienced investors, these derivative products provide ways to speculate on the price of silver.

Factors That Affect the Price of Silver

The price of silver is influenced by a complex interplay of global factors, making it essential for investors to understand what drives these changes. The following are some key factors that significantly impact the price of silver.

Economic Conditions

Global economic conditions play a crucial role in determining the price of silver. In times of economic uncertainty or downturn, investors often turn to silver as a safe-haven asset, driving its price. Conversely, when the economy is strong, the demand for silver can decrease as investors turn to higher-yield assets.

Industrial Demand

Silver’s extensive use in various industries, from electronics to solar panels, means that industrial demand significantly impacts its price. Any growth or decline in industries that use silver extensively can directly affect its market value.

Currency Fluctuations

Silver prices are closely tied to the strength of the U.S. dollar, as it is the primary currency used in silver transactions worldwide. A strong dollar can make silver more expensive in other currencies, reducing demand, while a weaker dollar can increase its attractiveness as an investment.

Supply and Mining

The availability of silver influences its price. If new silver mines opened or existing mines increase their output, an increased supply can lead to lower prices. Conversely, higher mining costs or reduced mining activity can decrease supply and increase prices.

Interest Rates

Interest rates set by central banks also affect silver prices. Higher interest rates can lead to higher yields on bonds and savings accounts, making silver less attractive as it does not generate interest. Lower interest rates can have the opposite effect.

Geopolitical Events

Political events and stability in countries that produce silver can influence its price. Conflicts, economic sanctions, or political unrest in these countries can disrupt supply, leading to price fluctuations.

Investment Trends

The behavior of investors also affects silver prices. Silver buyers are influenced by market trends, news, and speculation, which can increase buying by large-scale investors and drive prices up while selling or reduced interest can lead to price decreases.

Benefits of Investing in Silver

There are plenty of benefits to investing in silver. The precious metal silver offers a tangible asset, is more accessible than gold, and is easily converted to cash.

- Tangible Asset: Unlike stocks or bonds, silver bullion offers a tangible asset that investors can physically hold. This tangibility provides a sense of security and permanence, highly prized in uncertain economic times.

- Cheaper than Gold: Silver presents an affordable entry point into the precious metals market. It’s cheaper than gold, making it accessible to more investors. This affordability allows for greater flexibility in investment strategies, whether buying small quantities over time or making larger, one-time purchases.

- Liquidity: Liquidity is a key feature of silver as an investment. While silver is not more liquid than gold, converting silver to cash can be fast and easy. There is a large community of silver stackers, ensuring customers will always be looking to buy silver when you need to sell it.

- Hedge Against Inflation: Historically, silver has been a reliable hedge against inflation. As inflation increases, silver typically holds its value, protecting the purchasing power of your investment.

- Diversification: Diversifying your investment portfolio is vital for risk management, and silver offers an excellent way to achieve this. Adding silver to your portfolio can balance risks associated with other asset classes.

Disadvantages of Investing in Silver

While silver has advantages, investors must be aware of its drawbacks. Understanding these challenges is critical to making well-informed investment decisions in the silver market.

- Volatility: Silver prices can be highly volatile, more so than gold. Various factors influence this volatility, including industrial demand, global economic conditions, and market speculation. Such fluctuations can lead to unpredictable investment returns and may not suit investors seeking portfolio stability.

- Storage and Insurance Costs: Owning physical silver, whether in bars, coins, or collectibles, incurs additional costs for secure storage and insurance. These ongoing expenses can impact the overall profitability of the investment, especially for smaller-scale investors.

- Lack of Yield: Unlike stocks or bonds, physical silver does not offer dividends or interest. The investment’s value depends solely on price appreciation, which may not occur over short or medium-term periods. This lack of passive income can be a significant drawback for those looking for regular income streams from their investments.

- Industrial Demand Risk: The price of silver is influenced by industrial demand, particularly in the electronics and solar energy sectors. Any downturn in these industries can negatively impact silver prices, making it a riskier investment than other precious metals less dependent on industrial use.

- Opportunity Cost: Investing a significant portion of funds in silver can lead to opportunity costs. Money tied up in silver may have earned higher returns if invested in other assets like stocks, real estate, or technology investments that could offer growth or income.

How to Invest in Silver

Now that you know the basics of investing in silver, you might be ready to invest in the precious metal. Learning how to invest in silver can feel overwhelming initially, but with the proper steps, you can find enjoyment and profitability.

- Research: Conduct thorough research or consult a financial advisor to understand the silver market.

- Decide on the Form: Choose between physical silver, stocks, ETFs, or derivatives based on your investment strategy.

- Find a Reputable Dealer or Broker: Ensure they are credible and offer fair market prices.

- Consider Storage and Insurance: Secure storage and insurance are vital if investing in physical silver.

- Stay Informed: Keep track of market trends and economic factors that influence silver prices.

Silver investment offers a unique blend of tangibility, affordability, liquidity, inflation protection, and diversification. Whether you’re a new investor or a seasoned one, understanding these basics can pave the way for informed and successful silver investments. It’s crucial to do your due diligence and consider your long-term financial goals before investing in silver.