Look into coin and currency collecting long enough, and you may notice that some paper currency is more expensive than bullion. While this isn’t always the case, when it happens you may question why are prices higher on paper currency than bullion? Understanding the pricing structures of both categories can shed light on this intriguing aspect of numismatics.

Understanding Bullion Pricing

Bullion products, whether gold, silver, or platinum, are priced primarily based on their metal content. The intrinsic value of these precious metals, driven by spot prices in the global market, forms the foundation for bullion pricing. However, other factors contribute to the variations in price among different bullion products.

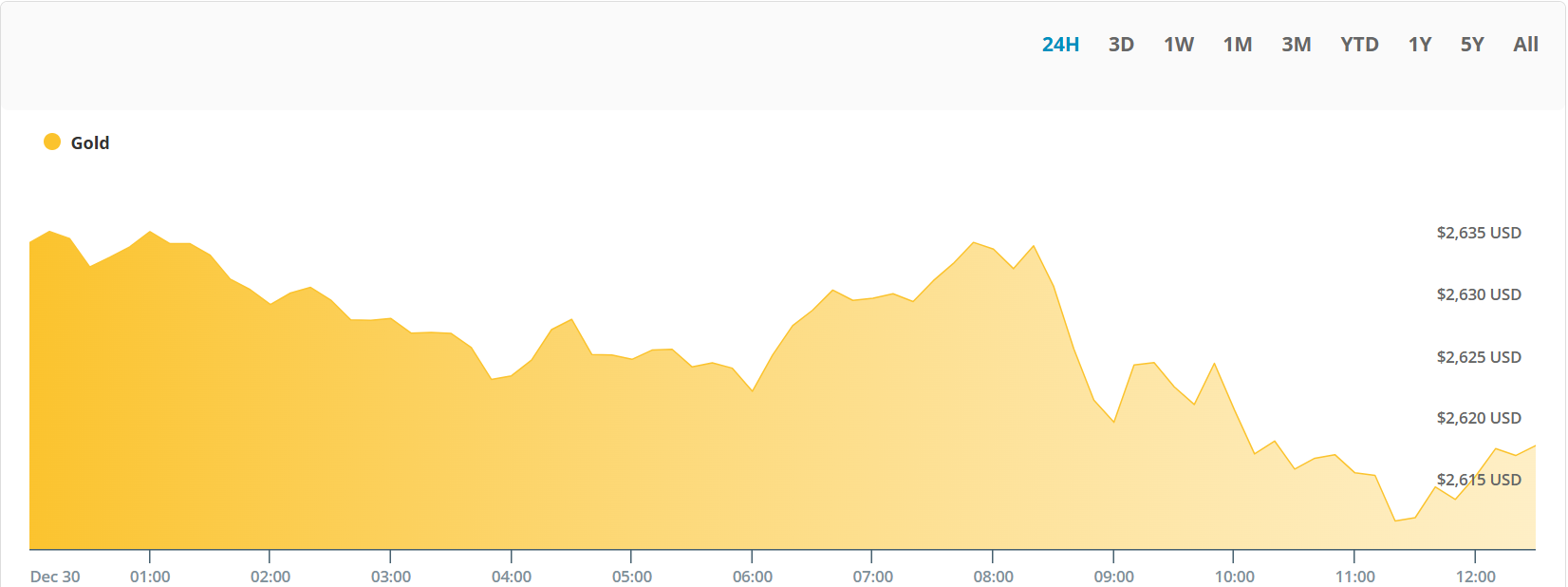

Metal Value and Spot Prices

The spot price of precious metals is the starting point for bullion pricing. This value fluctuates daily based on global market trends, including supply, demand, and economic conditions. Bullion products, such as coins, bars, and rounds, are priced with a premium over the spot price to account for manufacturing, distribution, and other associated costs.

For example, an American Gold Eagle will often have a higher premium than a standard gold bar due to its status as a sovereign mint product and its popularity among collectors and investors alike.

Mint Type: Sovereign vs. Private

One key factor influencing bullion prices is whether the product comes from a sovereign mint or a private mint.

- Sovereign Mints produce coins backed by their respective governments, ensuring guaranteed purity and legal tender status. Examples include the U.S. Mint, Royal Canadian Mint, and Perth Mint. These products often carry higher premiums due to their reputation, collectibility, and added assurance of authenticity.

- Private Mints offer bullion that focuses primarily on metal content, often at lower premiums. These products, such as silver bars or generic rounds, appeal to investors seeking the most cost-effective way to acquire precious metals.

Popularity and Collectibility

Certain bullion products command higher premiums due to their popularity. Limited releases, unique designs, or commemorative editions often attract collectors, driving up demand. For instance, limited-edition coins like the Perth Mint’s Lunar Series or the U.S. Mint’s Proof Gold Eagles can see significant price differences compared to standard bullion coins.

Certification

Certification by trusted third-party grading services, such as the Numismatic Guaranty Corporation (NGC) or Professional Coin Grading Service (PCGS), can also impact bullion prices. Certified bullion coins, graded for quality and authenticity, often carry higher premiums than their uncertified counterparts. While certification doesn’t affect the intrinsic metal value, it adds assurance and appeal for collectors who value condition and rarity.

Paper Currency Pricing

Paper currency, unlike bullion, derives its value from factors beyond its intrinsic material. Historical context, rarity, and collector demand are the primary drivers of paper currency pricing. These elements create a unique market where the significance of a note can far outweigh its face value.

Historical Context and Demand

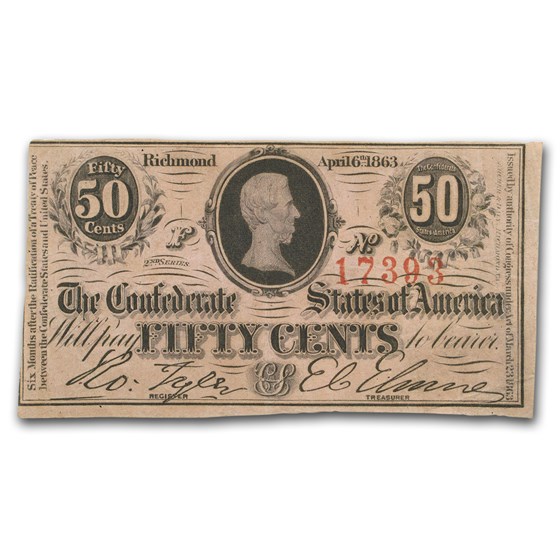

The history tied to a specific note often plays a significant role in its value. Currency associated with pivotal moments, such as the Civil War or the Great Depression, garners interest from collectors and historians alike. For example, Confederate currency holds a unique place in numismatics due to its role during the Civil War, attracting U.S.-based collectors but less interest internationally.

Demand for paper currency also fluctuates based on global trends and collector preferences. Some notes, like Federal Reserve Notes from specific years such as 1929 or 1933, hold higher value because of their connection to economic downturns and historical necessity during those periods.

Rarity

Rarity directly affects a note’s value. Limited print runs, unique serial numbers, or notes from short-lived issuances create scarcity that drives higher prices. A prime example is the 1934 $10,000 Federal Reserve Note, which had an extremely low production and was used primarily for interbank transactions. Today, it is one of the most coveted pieces in paper currency collecting.

Comparatively, some modern notes, such as Zimbabwe hyperinflation notes, are valued for their rarity despite being relatively recent. Their astronomical denominations reflect a unique economic moment, making them intriguing and collectible worldwide.

Condition and Certification

The condition of a note significantly impacts its value. Notes graded as Gem Uncirculated—free from folds, stains, or wear—command higher prices. Certification by trusted services such as PMG (Paper Money Guaranty) assures authenticity and provides a clear grading scale for collectors. Similar to bullion certification, this adds a layer of confidence and often increases a note’s appeal.

Cultural Relevance

Certain notes gain value due to their cultural or historical significance. For instance, U.S. Bank Notes, phased out in favor of Federal Reserve Notes, are sought after for their place in U.S. monetary history. Similarly, foreign notes, like the German Papiermark from the hyperinflation period of the 1920s, offer insight into historical economic conditions and attract niche collectors.

Comparison: Paper Currency vs. Bullion

When comparing paper currency and bullion, their pricing structures and market influences are different. Each holds unique value for collectors and investors, but the factors driving their prices vary.

Intrinsic Value vs. Historical Value

- Bullion derives its value primarily from the metal content, making it a tangible asset tied to the global spot price of gold, silver, or platinum. The weight and purity of the metal are the core determinants of its price, with additional premiums for specific designs or certifications.

- Paper Currency often gains its value from its historical and cultural significance. A note’s rarity, condition, and role in historical events can far outweigh its original face value.

Market Fluctuations

- Bullion prices are heavily influenced by market trends, including global economic conditions, geopolitical events, and inflationary pressures. Investors often turn to bullion as a hedge against currency devaluation or market volatility.

- Paper currency values, however, are less tied to daily market fluctuations. Instead, collector interest, auction results, and discoveries of rare notes play a significant role in determining value over time.

Rarity and Supply

- While some bullion products, such as limited-edition coins, can experience price increases due to rarity, most bullion products are widely available, with their prices dictated by metal content.

- Paper currency often benefits from inherent scarcity. Notes with limited print runs, specific serial numbers, or unique features such as printing errors can become highly sought after, commanding significant premiums.

Investment Perspective

- Bullion appeals to investors looking for a stable, tangible asset that can be liquidated easily. It is often considered a safe-haven investment during economic uncertainty.

- Paper currency is more of a niche collectible. While some notes can offer impressive returns due to rarity or historical interest, they are typically less liquid and cater to a specialized market.