Gold and silver prices move independently from the stock market. However, like stocks, it is difficult to predict when precious metals prices will go up or down. Investing requires diligent attention to precious metals pricing, while history plays an important role as well. Modern bullion investors have several options to choose from, like gold Maple Leafs or silver Libertads.

How do you know which investment sets you up well now and for the future? In order to answer that, you must have a basic understanding of modern bullion investing.

A History of Bullion Investing: The Gold Krugerrand

Investing in coins traces back to the South African Krugerrand. First minted in 1967, the Krugerrand was originally designed for the general public around the world to have ownership of gold. The 1960s and 70s were a time when several countries were not allowed to own gold bars or rounds of any kind. The South African Mint struck these gold bullion coins as legal tender made of an alloy of 91.7% gold and 8.3% copper.

The Krugerrand being considered legal tender allowed anyone to buy them. The biggest issue with this was South Africa’s commitment to Apartheid. At the time, the United States and many other countries banned the import of these coins. Investors could not import Krugerrands to the U.S. until Apartheid ended in the 1990s.

This history is important because it highlights the Krugerrand’s role as a practical gold bullion investment tool in the 1960s. This, coupled with a new watchful eye on precious metals prices, allowed the Krugerrand to grow. Especially important was its status as legal tender, which made it accessible to buyers from all over the world. Buying Gold Krugerrands in the 1960s set a precedent for modern investing in bullion. Today, there are few restrictions on collecting or investing in bullion.

Options for Modern Bullion Investing

Whether you are interested in investing in silver or gold bullion, there are many quality options. If history is any indication, coins produced by sovereign mints offer great value, as they are legal tender with guaranteed metal content. Here are a few other options that are popular with modern bullion investors:

Austrian Philharmonics

The Philharmonic is a bullion coin made of silver, gold or platinum by the prestigious Austrian Mint. The Gold Philharmonic was created as a gold tribute to the renowned Vienna Philharmonic Orchestra, one of the world’s most well-known orchestras. The obverse depicts the Great Organ of the Golden Hall in Vienna’s concert hall, the Musikverein. These coins come in 1 oz silver, 1 oz platinum and a variety of gold weights, from 1/25 oz up to 1 oz. According to the World Gold Council, Gold Austrian Philharmonics were the best-selling gold coins in the world in 1992, 1995, and 1996.

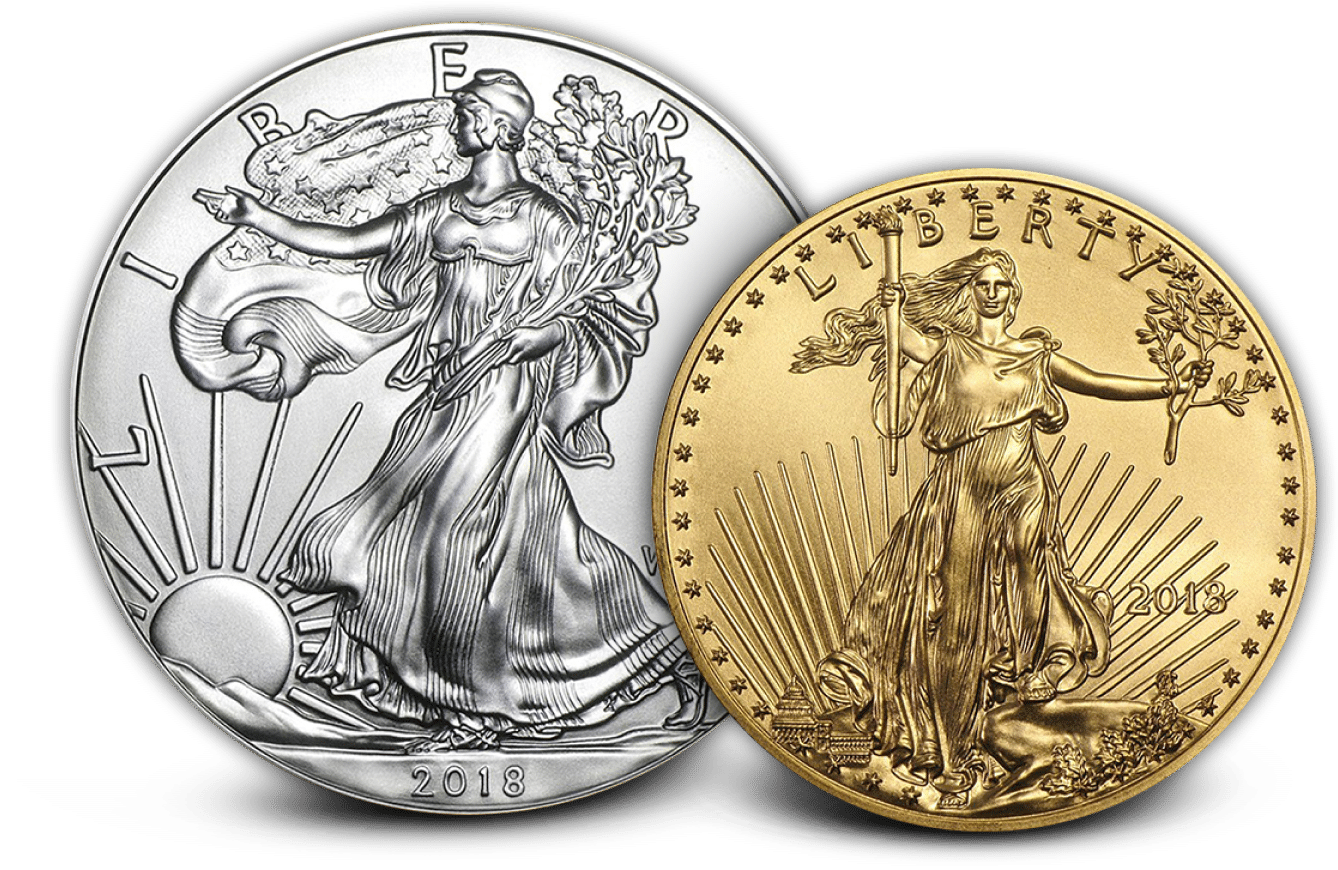

American Eagles

The American Eagle coin comes in a variety of denominations, designs, and metals. American Eagles coins are produced by the U.S. Mint. Two American icons, the eagle, an unwavering representation of the United States, and Lady Liberty, have appeared on American Eagles since their first minting in 1986. The Silver Eagle features a design based on the original 1916 Walking Liberty Silver Half Dollar while the Gold Eagle takes its design from the 1907 Saint-Gaudens Gold Double Eagle. The Platinum Eagle features a close-up of the iconic Statue of Liberty.

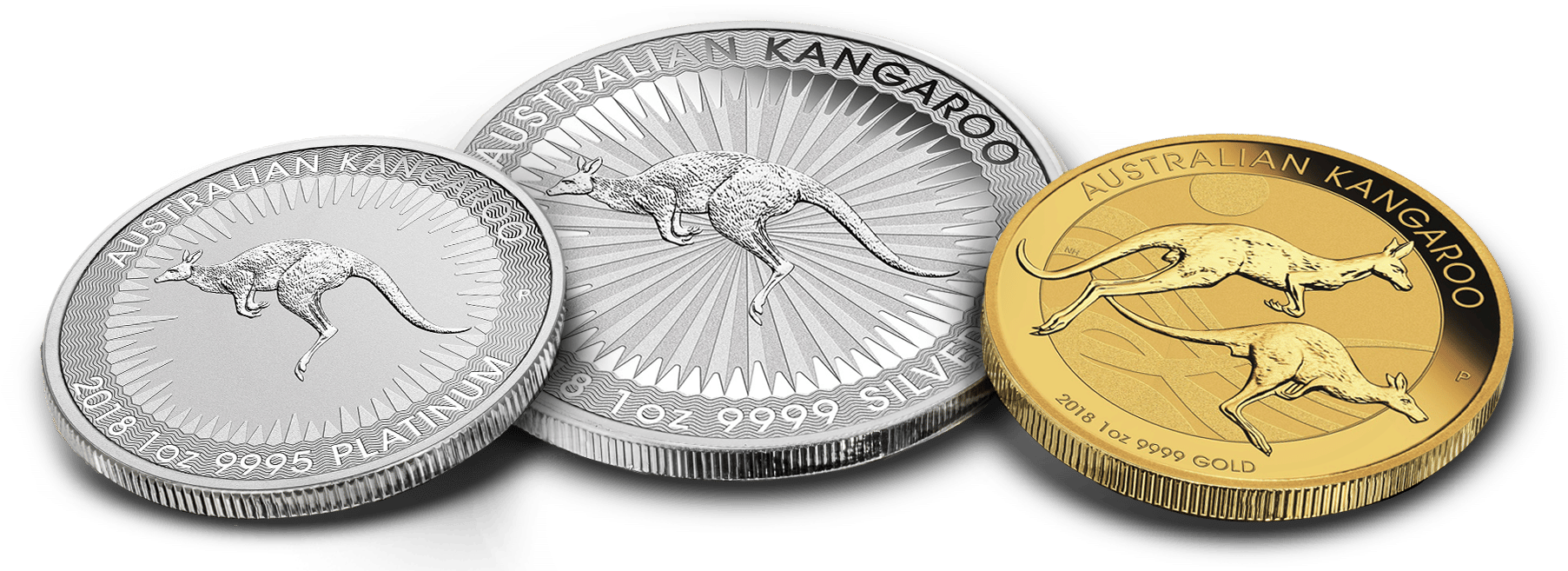

Australian Kangaroos

Struck in .9999 fine Silver, this Australian coin from the Perth Mint is highly desirable to investors and collectors. Gold Kangaroos were introduced in 1990. The Gold Kangaroo is among the few major gold bullion coins that change their reverse design annually.

Canadian Maple Leafs

Widely considered the world’s most beautiful coin, the Maple Leaf is a work of fine production by the Royal Canadian Mint. The coin depicts Canada’s iconic maple leaf on the reverse and Queen Elizabeth II on the obverse. Newer versions depict King Charles II. The silver and Gold Maple Leafs are considered legal tender honored by the Canadian government. The Maple Leaf is one of the most highly sought-after coins by investors and collectors because of its attention to detail and precision.

Chinese Pandas

Chinese Panda coins are produced by the Central Mint of China but are widely popular all over the world. The Chinese Panda series began with a gold coin in 1982, followed by silver in 1983. This series has stood the test of time due to its quality gold and silver content along with the iconic designs. Each year depicts the animal most closely associated with China, the great panda. The obverse of each coin depicts the Hall of Prayer for Abundant Harvests in the Temple of Heaven in Beijing, bringing in another timeless Chinese element. The single-ounce Chinese Gold Panda coin remains one of the most popular in the series, year after year. It should be noted that new coins are sold in grams.

The appeal of investing in bullion is different for each buyer, but the vast array of options to choose from ensures there is something for everyone. Novice and experienced investors can find something within their budget and investment strategy. Having a good understanding of what makes bullion so unique and valuable will go a long way in helping you develop and reach your investment goals.

APMEX recommends discussing the pros and cons of investing with a financial advisor or professional.