What is a $2 Bill Worth?

As with coins, numerous factors play into the value of paper currency. These include the relative scarcity of the bill, its condition, its age, and what collectors are willing to pay. Unlike most coins, currency items have serial numbers that can make paper money more valuable.

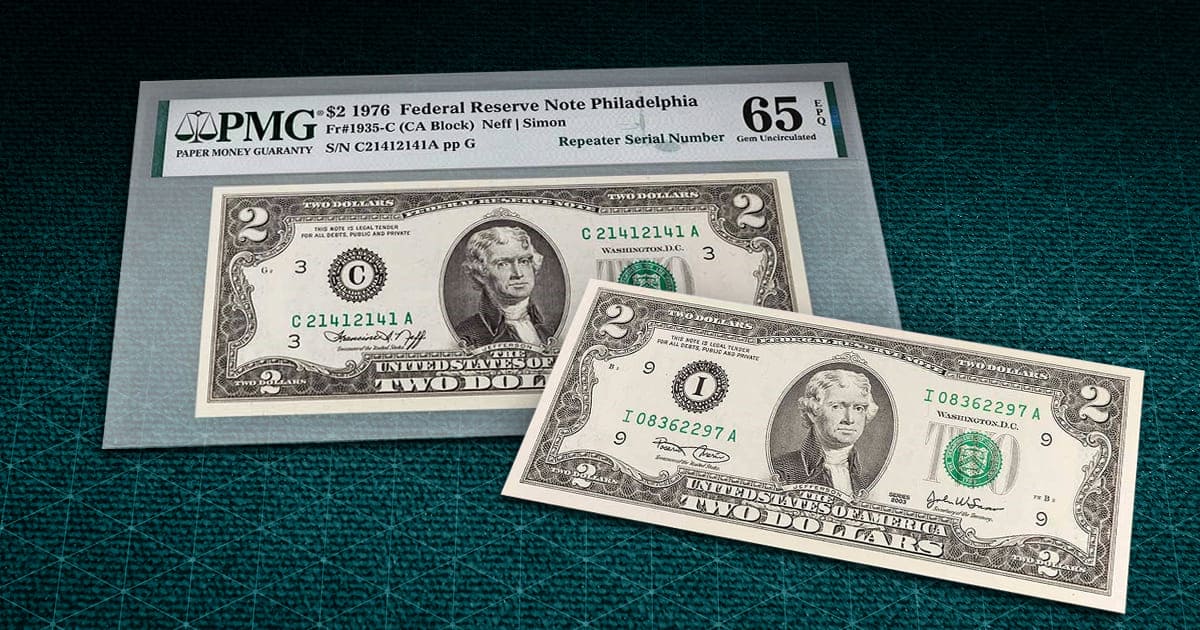

There are many factors to consider when determining the value of a $2 bill. The best way to find the value of yours is to have it graded by one of the reputable grading organizations like PCGS and PMG.

History of the $2 Bill

The two-dollar bill was printed from 1862 through 1966 and from 1976 until the present day. It has been issued as United States Note, a Silver Certificate, a Treasury Note, and a Federal Reserve Bank Note.

Because of their limited use, $2 Federal Reserve Notes are not printed as often as other denominations in a new series of currency. Most automated bill collectors in vending machines, transit systems, and self-checkouts can accept $2 notes, although their labels may not state this.

Finding the Value of Your Two Dollar Bill

Was your $2 Federal Reserve Note printed on or after 1976? Even this relatively new note may be worth more than its face value. In some cases, it may be worth quite a bit more, depending on its condition, serial number, and population size, or how many bills in the same grade are known.

A $2 bill that was printed before 1976 falls into one of the previously described categories and in decent condition should be worth several times the face value. $2 United States Notes in Uncirculated condition can bring in thousands of dollars and Silver Certificates can fetch more than $250 in stellar condition.

The value of a $2 Bill greatly depends on the type, year, condition, and serial number. The value ranges anywhere from just over face value to thousands of dollars. Uncut sheets and consecutive serial numbers are worth much more than their face value.