1. Gold Performance by Month

2. Silver Performance by Month

3. Gold Performance in Recession

4. Silver Performance in Recession

5. The Right Time to Buy Precious Metals

6. How Timing the Market may Backfire

7. What We Learned

When is the best time to buy precious metals? This is a conundrum that investors strive to decipher. Is there a better month to buy gold? Or quarter or a season? Should I buy during economic strife or when the market is booming? Should I try to time the market or stick to a dollar-cost-averaging strategy? And what about silver?

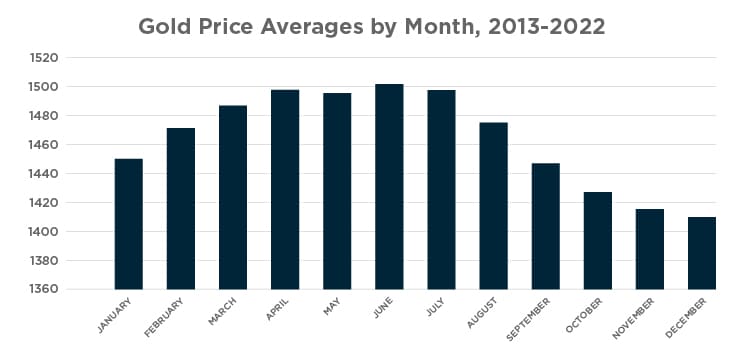

Does Gold Perform Better at Certain Times of the Year?

To find out, we charted the most recent ten years of gold price data. The data revealed some interesting insights. Looking at the last ten years of gold price data, we discovered that December has the lowest average price of all months, and June has the highest average.

This appears to be a considerable difference. However, if you set the y-axis on these charts to have a minimum value of zero, the data seems less dramatic. The variance between the months is less significant than initially appears.

December’s average gold price over the past ten years was $1,411, while June’s average was $1,501. On average, there is about a $90 difference between December’s and June’s prices. When gold is priced at approximately $2,000 per troy ounce, $90 is about a 4.5% difference.

There is a vast range of price movements in any given month, so we also looked at the highest highs and the lowest lows. Over the past ten years, the lowest price did occur in December, but August had the highest gold price.

The goal of any asset or investment should be to buy low and sell high. Does this mean you are guaranteed to profit if you purchase in December and sell in June or August? Unfortunately, no, because the variance within a month is an overriding factor.

The lowest recorded closing price in June was $1,168, while the highest was $1978. Every month, there is a difference between the highest and lowest recorded prices of $800 – $1000. For example, if you bought gold in December 2020, the average close price was $1862. And in June 2021, the average comparable price was $1835, but the prices varied throughout the month. You would have made money if you had sold at the start of June. You would have lost money if you sold at the end of June.

If you buy in December every year, you theoretically will get a better price on average. But the truth is more complex. When you break the data down and look at the numbers closer, you see the variance in each month is too large for this to be a reliable strategy.

Similarly, we do not find there is one quarter or season of the year where you will have an advantage.

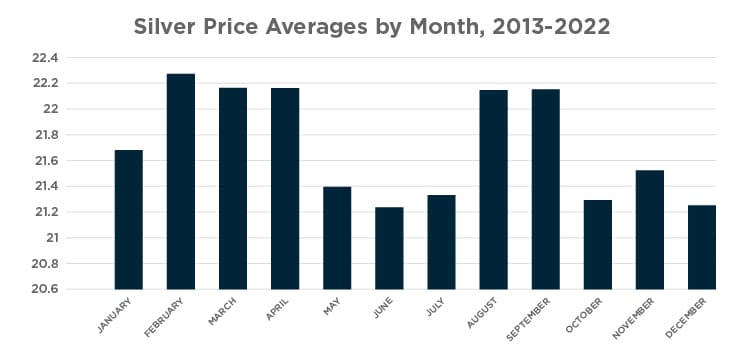

Is there a Better Month to Buy Silver?

We performed a similar analysis on silver using the past ten years of silver prices and found that December and June had the lowest average prices at $21.24 per ounce. The highest average price was in February, at $22.27 per ounce. This difference is $1.03 between the highest and lowest average prices, less than the premium on most silver products.

Like our prior analysis, the difference between the lowest and highest prices in each month is significant. This negates using a particular month as a buy or sell indicator for silver, like gold.

Should You Buy Gold in Recessions?

In three out of the last three recessions, if you had bought gold in the three months leading up to the official start of the recession, you would have seen an increase in value during the recession. In addition, if you had bought gold during the recession, you would have seen another value increase during the six months after the recession had officially ended.

The value of gold increased during the recessions and after the recessions.

2001 Recession

If you had bought gold during the 2001 recession, the average value would have increased by 7.5% in the six months following the recession. If you had bought gold three months before the recession started, you would have seen a 10.4% increase if you held it through the recession and sold it during the aftermath.

2008 Recession

During the 2008 recession, if you bought gold in the middle of the recession and sold it in the six months after it ended, you would have netted a 14.5% return. If you purchased gold three months before the recession’s start, that gain would have been 36%.

Covid Recession

In the short-lived Covid recession, buying gold during the recession and selling it after would have provided a 12.1% return, while purchasing gold before and selling it after the recession ended would have netted a 23% gain.

| Timeframe | Gold Price | Increase |

| 3 months before 2001 recession | $ 266.27 | |

| Average during 2001 recession | $ 272.07 | 2.1% |

| 6 months after 2001 recession | $ 294.01 | 7.5% |

| 3 months before 2008 great financial crisis | $ 757.83 | |

| Average during 2008 great financial crisis | $ 881.81 | 14.1% |

| 6 months after 2008 great financial crisis | $ 1,030.85 | 14.5% |

| 3 months before 2020 recession | $ 1,502.24 | |

| Average during 2020 recession | $ 1,623.99 | 7.5% |

| 6 months after 2020 recession | $ 1,847.16 | 12.1% |

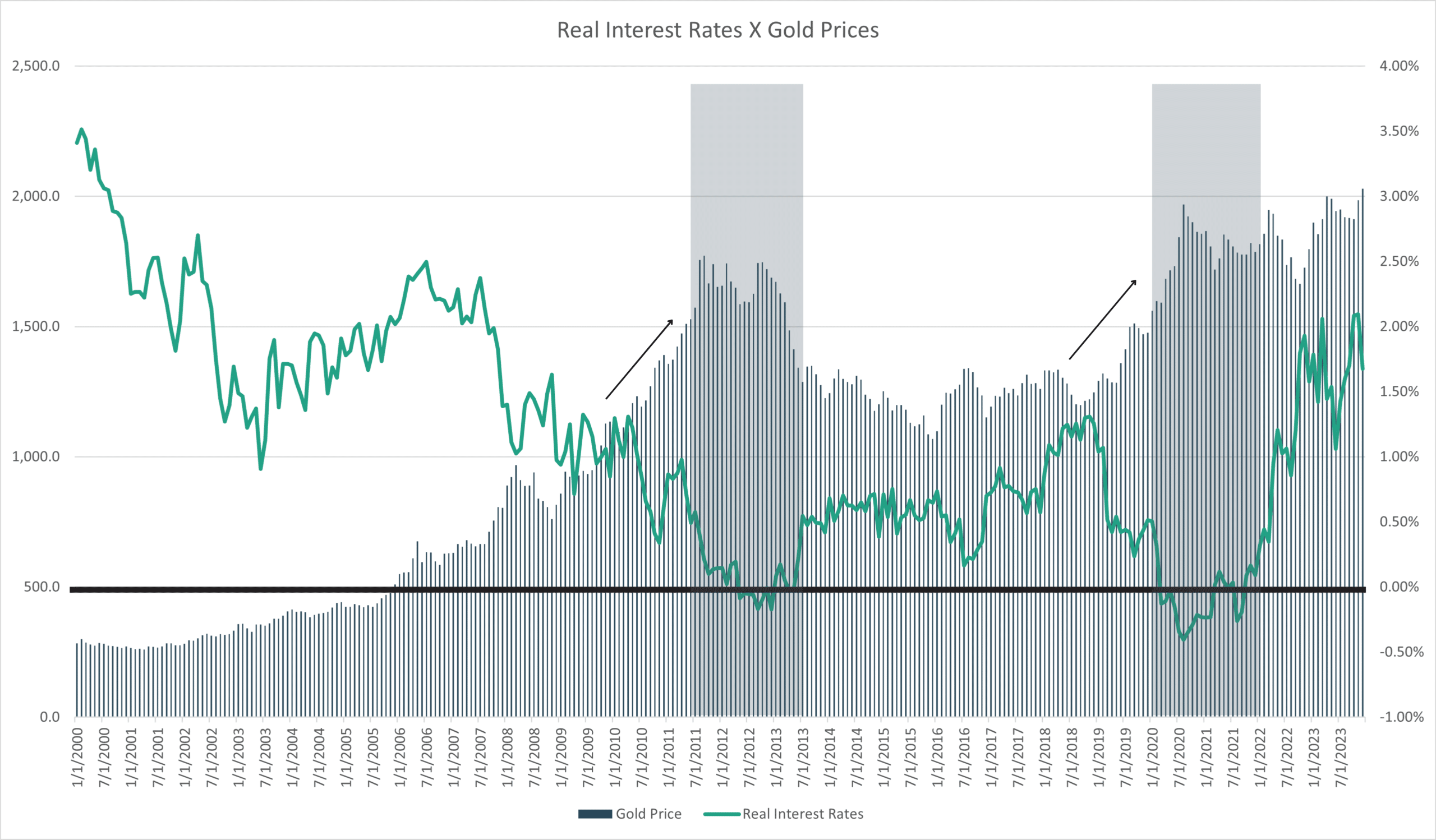

The trend is that buying before a recession yields some returns during the recession and even more significant returns after the recession ends. But there is another variable that explains this phenomenon more fully.

The interest rates the Federal Reserve sets significantly impact gold prices. The Fed tends to cut the Fed funds rate whenever a recession occurs, or they have indicators of great economic stress. They have done so in the last three recessions.

The 2001 recession was officially declared in March 2001. The Fed began to cut rates in February 2001. In the Great Recession, the Fed began to cut rates about two months before the recession’s official start date. When the Covid recession began in February 2020, the rates were cut immediately in an emergency to zero in March.

Real interest rates correlate negatively with the price of gold. This means that when real interest rates drop, gold demand and gold prices increase. Real interest rates are nominal rates minus the rate of inflation. With low nominal rates and high inflation, real interest rates sometimes turn negative, which is when gold prices tend to perform their strongest.

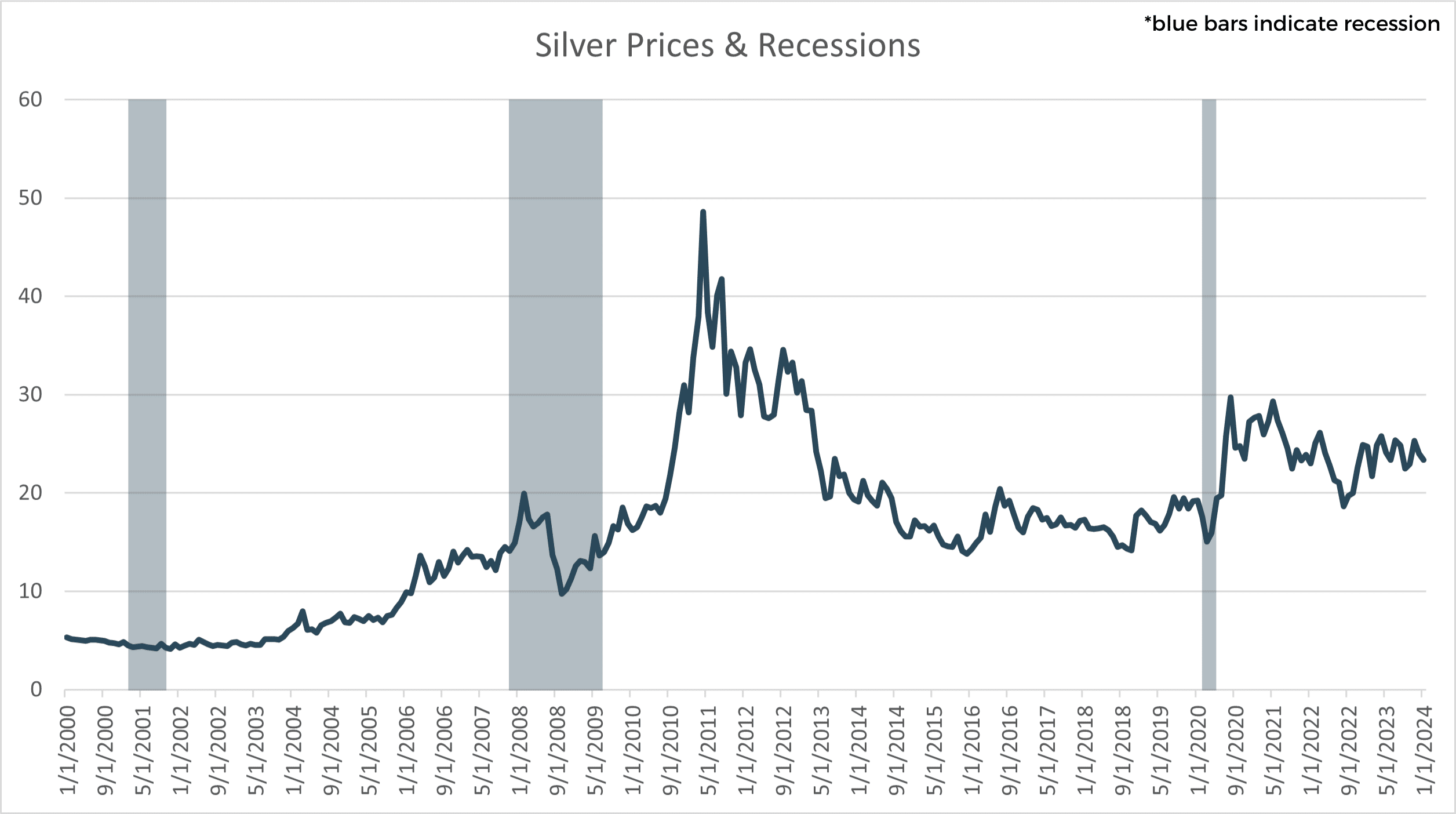

Should You Buy Silver in a Recession?

Silver is different than gold in its utility. Gold and silver were historically used as money because they were the metals best suited for it. Both have relatively low melting points, are soft enough to be minted into coins with primitive tools, are rare enough to be valuable and have a controlled supply, but plentiful enough to support currency for nations worldwide. They are also relatively inert. Using a metal like iron for coins would not be prudent because the coins would rust away into nothing over time.

Gold’s primary function is as money and a store of wealth. Over 90% of all gold mined is used as a financial instrument or jewelry. However, silver has unique properties that make it ideal for industrial uses. Industrial demand for silver is forecasted to be 86% higher than bullion demand for 2023. Recession risks for silver are typically higher than gold because there is less demand for industrial silver during a recession. While gold has often performed better in recessions, silver has not always followed suit.

While the typical wisdom of silver performing poorly in recessions has merit, the silver price bottomed out in the 4th quarter of 2008 close to $10 per ounce. Two years later, the silver price was over $25 an ounce. If you were buying silver then, you would have seen a 150% return on investment, bucking conventional wisdom. In March of 2020, when there was deep concern about the economy, silver dropped to an extreme low below $15 an ounce, only to recover and spend most of this period above $20 an ounce between 2020 and 2023.

Silver is resilient for patient investors.

The Right Time to Buy Precious Metals

There is a saying, “Time in market is better than timing the market.” No one knows when prices will go up or down or when the next super cycle may start. Investors who want to invest wisely and are risk-averse tend to use a strategy known as dollar-cost-averaging. Dollar-cost-averaging is buying fixed investments over time in equal increments. This spreads out risk and lowers the average cost of an investment. This works for precious metals as it does for retirement accounts made of stocks and bonds. If you have an IRA or 401k, you regularly contribute to it, it is the same strategy.

| Timing | Ounces | Price per Oz | Total Price |

| January | 10 | 26.95 | 269.50 |

| February | 10 | 26.95 | 269.50 |

| March | 10 | 23.97 | 239.70 |

| April | 10 | 26.94 | 269.40 |

| May | 10 | 27.94 | 279.40 |

| Total Troy Ounces | Average Price/Oz | Total Price | |

| 50 | $26.55 | $1,327.50 |

In the example above, we took silver prices from the first few days of each month in 2023 and applied a premium of $2.99 to simulate real world conditions. Investors who used a dollar-cost-averaging strategy to accumulate ten ounces of silver each month near the first of the month would have paid an average of $26.55 per ounce.

Let us see how that compares to buying just once at the start of the year.

| Timing | Ounces | Price per Oz | Total Price |

| January | 50 | 26.95 | $1,347.50 |

| February | 0 | 0 | 0 |

| March | 0 | 0 | 0 |

| April | 0 | 0 | 0 |

| May | 0 | 0 | 0 |

| Total Troy Ounces | Average Price/Oz | Total Price | |

| 50 | $26.95 | $1,347.50 |

The dollar-cost-averaging strategy provides a lower average price due to a price dip in early March. This reduced the average price per troy ounce by $0.40, and the total cost of investing in 50 ounces of silver reduced by $20.

This illustrates that when to buy is less important than how to buy. Investors who want to use this strategy to reduce investment costs and risks should consider our AutoInvest program. AutoInvest is designed around the concept of dollar-cost-averaging. Investors who sign up for AutoInvest choose a product and how often they want to purchase it. The process takes only a few minutes and allows investors to take advantage of a time-tested investment strategy.

Why Waiting Can Backfire

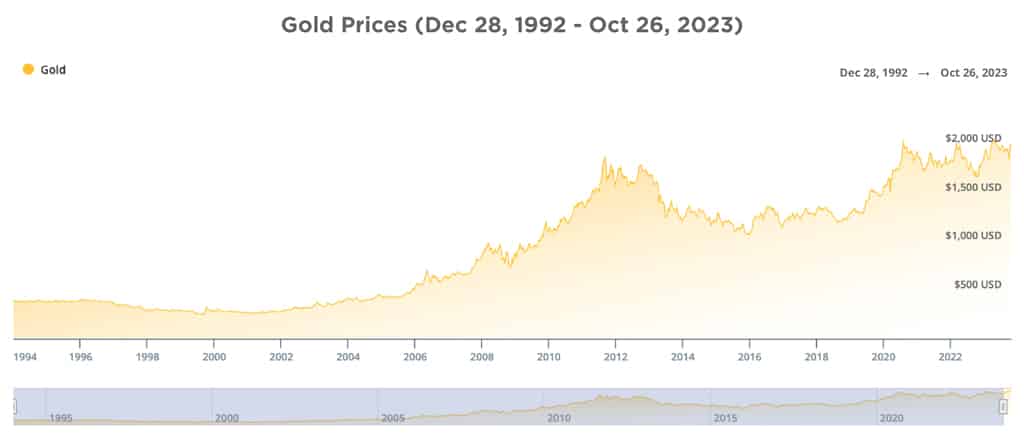

Waiting for the right time is the same as attempting to time the market. Gold investors know the pain of waiting for the right moment. Gold prices in the early 2000s were less than $300. Then, the price of gold rose, going past $400, then past $500, and so on, until it peaked at over $1,800 per ounce in 2011.

Investors who decided to wait for gold to drop below $1,000 an ounce before investing in the precious metal are still waiting. Gold has not dropped below $1,000 an ounce since 2009. Yet it did drop from 2013 to 2019. Investors using a dollar-cost-averaging strategy to purchase through this period would gain a healthy profit if they chose to sell now.

This provides further evidence that time in the market beats timing the market and that dollar-cost-averaging can help reduce risk and lower the cost of investing. Investors who chose to wait for an ideal price target missed the profit they could have realized from gold.

What We Learned

Timing the market is not easy and is not usually advised. We did not discover that a particular month or economic cycle is a reliable indicator of when to buy gold or silver, as too many variables influence prices. The data indicates that a dollar-cost-averaging strategy, done consistently over time, will yield a lower average cost of ownership and more reliable gains.