Do Bond Yields Affect the Gold Market?

Is there an inverse correlation between gold and bonds? This complicated relationship is influenced by various factors, including economic, geopolitical, and market conditions.

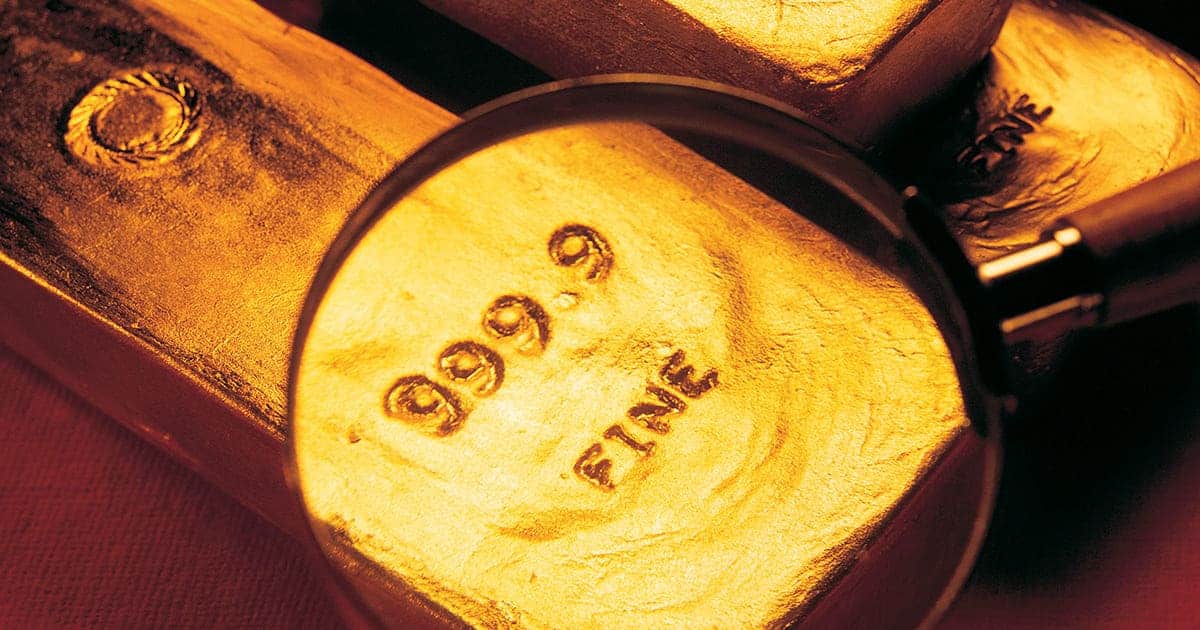

Price is a determining factor in all things we consider buying, including Gold and Silver. Learning the historical and current price trends of Precious Metals can help you to better understand the factors that influence the global market daily.

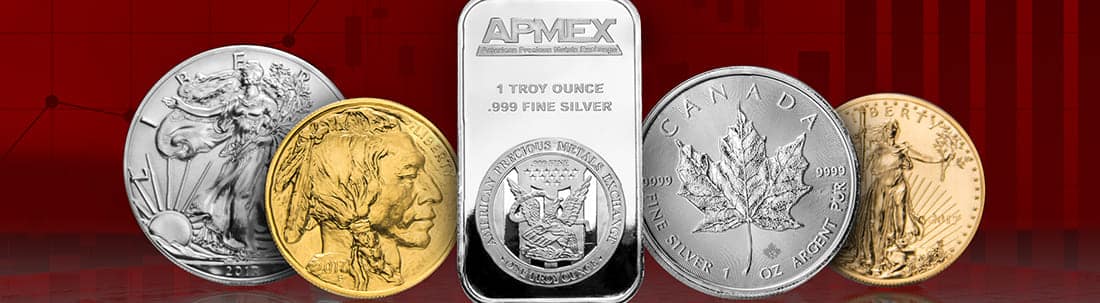

Gold, Silver, Platinum, and Palladium all come in various forms and sizes to create a variety of options for investors and collectors.

Since the U.S. Mint’s American Eagle program began in 1986, Gold and Silver Eagles have remained a popular choice among both investors and collectors