Some banks and banking institutions in the United States sell gold and other precious metals, but this is not a widespread practice. For those who appreciate the reliability of federally regulated institutions, banks may seem like a viable and sound option for purchasing gold bullion products. If you find a bank that sells gold products, they are likely to charge a higher price than a traditional precious metals dealer.

Buying Gold from Banks

If you proceed with buying gold from a bank, there are several factors to remain aware of.

Limited Availability

Although some U.S. banks sell gold coins and bars, most do not. One of the main reasons your local branch may not offer American Gold Eagles or other gold bullion products is due to the fluctuating price of precious metals like gold. If you do happen to find a bank that sells gold, you may not have very many choices. Most of the banks that sell gold products have a small product offering that lacks variety, which may add a layer of difficulty to finding the gold coin, round, or bar you would like to invest in.

High Premiums

Another thing to keep in mind when considering a gold purchase directly from a bank is the premium. While some banks may sell gold products like gold coins, they generally charge a higher premium over spot than a dedicated precious metals retailer or dealer will. Many banks in the U.S. that sell gold sell it for a premium of 7-10% above the market value, and transaction fees may also be included. There are several reasons for this.

Business Model

Banks deal with finances, typically focusing on the currency of the nation that they are in and not on selling precious metals. They may buy some gold bullion, but their volume is very low, which impacts their ability to offer competitive pricing. Their business is currency (and related credit) and things related to the use of this financial tool.

Overhead Costs

Another factor that will impact the premium you pay at the bank for a gold bar, round, or coin is overhead costs. Banks have higher operating costs because running multiple physical branches requires paying rent or mortgages, security, staff, and maintenance. These costs are spread across the body of services, including the sale of gold. If a bank seldom sells gold, the extra work required by the staff to conduct the sale may also be represented by a higher premium.

Convenience and Trust

Some investors who have existing relationships with a bank might choose to buy gold from the bank due to their trust in the establishment. Banks, like other businesses, may leverage their brand reputation and perceived security to command higher premiums. The bank may even position itself as a reliable source of gold products.

Relative Liquidity

Banks do not typically buy gold from customers. While central banks are one of the biggest gold buyers, they primarily deals with governments, other banks, and financial institutions. Local branch banks rarely, if ever, buy gold back.

Buying gold from banks entails a smaller, limited product offering, paying higher premiums, and little to no chance for a buyback. What is the alternative?

Reasons to Consider Buying Gold from Precious Metal Dealers Instead

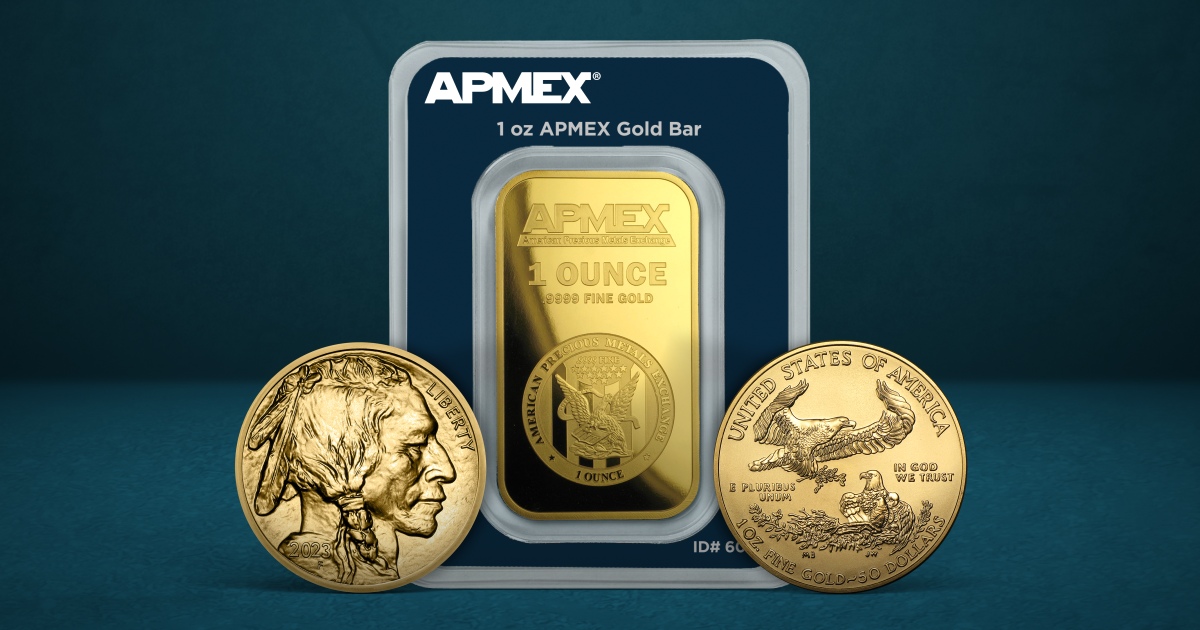

Purchasing gold products from banks comes with some caveats, like smaller, limited product offerings, higher premiums, and a low chance of precious metals buyback. Specialized dealers and online retailers like APMEX offer broader selections of products, competitive pricing, a buyback program, and conveniences like discrete home delivery.

Why do Dealers Charge Lower Premiums?

Banks specialize in currency, and some offer precious metals in addition to their body of services, while precious metal dealers specialize in precious metals. The primary service a business offers is what the business does the best and does so most affordably. To frame this in everyday occurrences, few people would want to purchase milk at a gas station. It will always be more expensive than at a nearby grocery store, and the premium will factor in things like convenience and overhead.

Can you buy gold from the bank? Some banks sell gold, but you might want to shop elsewhere. Banks are essential institutions that help to store cash and keep local communities and broader society running, but if you are ready to buy gold, there are better options. If you need gold products with no alternative but a bank, consider asking the teller about any applicable fees, surcharges, or other premiums before making your purchase.