If you know the weight of your gold products and are trying to determine the value of your 22 karat (22K) gold, there is a one-step solution. The APMEX gold price calculator makes finding the value of your 22 karat gold easy.

Calculating the Value of 22 Karat Gold

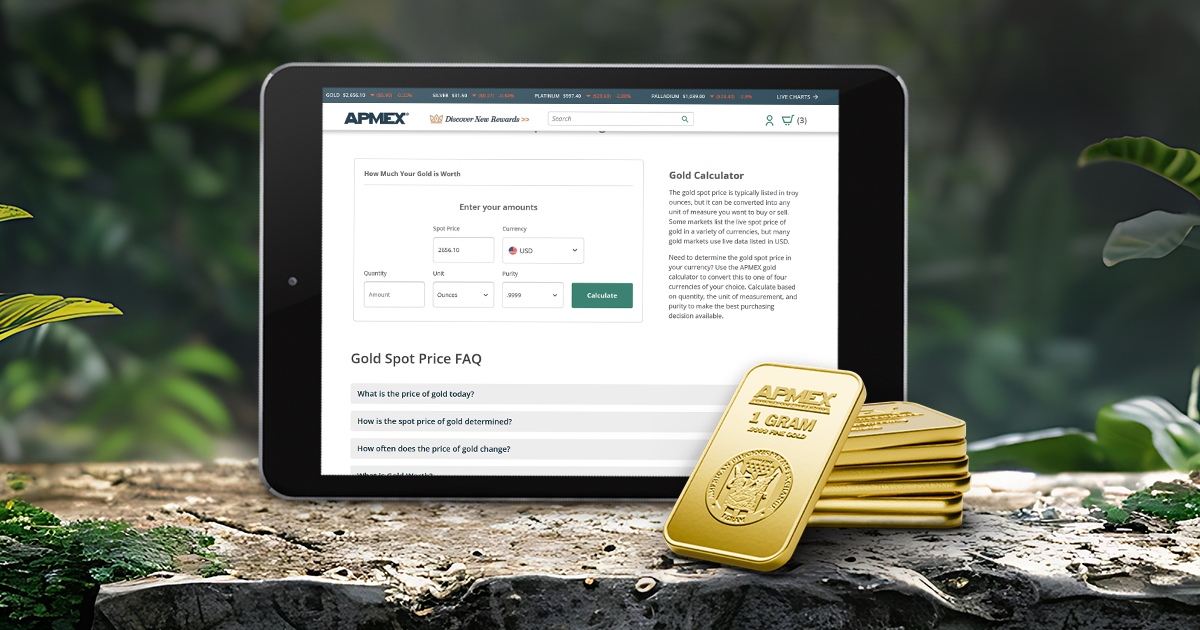

Using the APMEX gold calculator to determine the value of your gold is simple and fast. The gold spot price and currency are already filled out in the calculator, but you may select a different currency and change the listed price if you wish. Regarding weight, it is imperative to use a precise scale to determine the exact value of your 22 karat gold. If you do not have one, a jeweler or bullion dealer may be able to weigh it for you.

Steps to Use the APMEX Gold Calculator for 22 Karat Gold

- Weigh your gold.

- Find the APMEX Gold Calculator on the gold price page.

- Add your 22 karat gold in one of the numerous available weights, including ounces, grams, and grains,

- Select .9167 (22 Karat) and click Calculate.

- The value of your gold will appear directly above the calculator.

What is 22 Karat Gold?

While 22 karat gold is less common than 14K or 18K gold, it is a composition used for jewelry and some coins and rounds. 22K gold translates to 91.67% pure gold; it is alloyed with 8.33% of other metals, which are often copper and silver. The composition makes it more durable than 24K gold, which is often too soft for wear-resistant jewelry or coins. 91.67% fine gold has been used for coins like the Gold Eagle series, but that is not the only .9167 fine gold coin.

.9167 Fine Gold Coins

The American Gold Eagle, South African Gold Krugerrand, and Gold British sovereign are also issued in 91.67% (0.9167 fine) gold for enhanced durability. These coins often sell for more than just their melt value due to factors like demand, rarity, and collector interest. While these coins have a numismatic value that exceeds their melt value, you may have a piece of jewelry you would like to find the value of to insure or sell.

How are the Gold Eagle and Gold Krugerrand .999 Fine?

If the Gold American Eagle and South African Gold Krugerrand are .9167 fine, how are they also .999 fine? They each contain a troy ounce of .999 fine gold, but their total weight is greater than one ounce.

The Gold American Eagle

For instance, the 1 oz American Gold Eagle contains one troy ounce of fine gold alloyed with copper and silver, for a total weight of 1.09 troy ounces, or 33.93 grams. This is how it can have one ounce of .999 fine gold and also have a .9167 composition. The Gold Eagle’s market value is primarily driven by the price of the gold it contains, plus a premium that reflects its desirability among investors.

The Gold Krugerrand

Similarly, the 1 oz Gold Krugerrand has one troy ounce of .999 fine gold, and its total weight is 33.93 grams. The remaining 2.82 grams are composed of copper, which is how it can also have one ounce of fine gold but an overall composition of .9167. The Gold Krugerrand has been valued by investors and collectors since its debut in 1967. Its enduring popularity is why Krugerrands fetch higher premiums than standard bullion coins, making them an attractive investment for those who wish to hold physical gold.

Other Gold Coins

The Gold British Sovereign has been issued with a .9167 fineness since the 1800s. While the Gold Sovereign weighs less than one ounce, it still features a .9167 gold composition. Its total weight is 7.98 grams, and the Gold Sovereign has 7.32 grams of gold, or just below one quarter ounce of gold content with a balance of copper. You may see it referred to as 11/12 gold and 1/12 copper.