Is it Better to Buy a Coin with a COA than a BU Coin?

With the myriad of options available in coin collecting, it might feel a little bit overwhelming trying to decide on your first purchases. Why would you want an uncirculated coin with a certificate of authenticity over a Brilliant Uncirculated coin? In this Answer, we will explain the difference to help you make an informed decision.

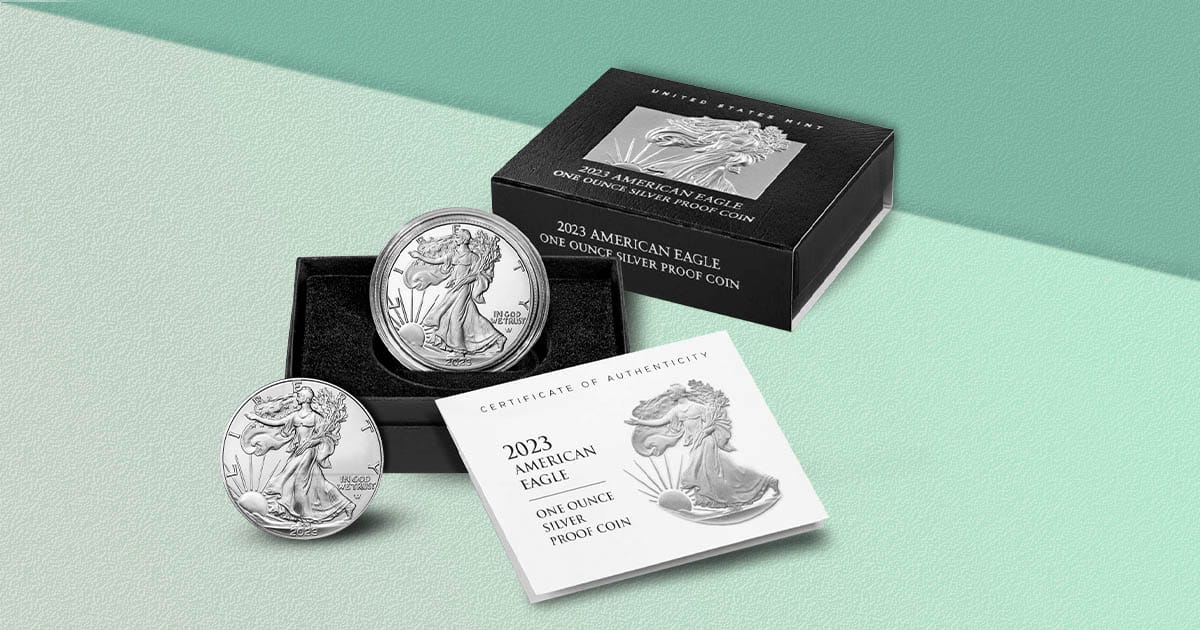

Coins with a Certificate of Authenticity (COA)

When a coin is sold with a Certificate of Authenticity or COA, the originating mint typically issues a COA. The United States Mint began issuing COAs with Proof coin sets in 1990 and issues them with many Proof coins today.

Certificates of Authenticity can provide detailed information about a coin’s rarity, grade, provenance, and reassurance that a coin is genuine. They allow buyers to check with the issuer to validate their coin’s authenticity and ensure it is not a copy.

Provenance is the term used to describe a coin’s ownership history. It supplies the record of where the coin has been, who has owned it, as well as any significant transactions or events in the coin’s history.

Provenance can be a key component for collectors since it can add to a coin’s historical significance and value.

Brilliant Uncirculated (BU) Coins

Brilliant Uncirculated coins are not held to the same standard as Proof coins but are struck with greater precision and beauty than business strike coins. Brilliant Uncirculated coins begin life as burnished blanks that are hand-loaded into a coining press and display a soft, matt-like finish.

These are issued primarily for collectors and are more valuable than business strikes but often less valuable than Proof coins. While the BU coin in our example does not come with a COA, it should keep its mint luster intact.

Mint luster is the term used to describe the satiny, frosty, or cartwheel-like shine that gleam from the face of a freshly minted coin. This special sparkle is due to metallic flow in the manufacturing process and indicates the age and condition of the coin. Its mint luster can diminish with wear and exposure to environmental elements.

Should You Buy a BU Coin or a Coin With a COA?

When trying to evaluate these two purchase options, the clear answer is to buy both or to assess what your intentions are first. Are you buying it for precious metal content or numismatic value?

Coins tell a story- One of history, drama, and value. BU coins tell a story of elegance and refinement. Coins with a Certificate of Authenticity relate a story with an index and table of contents.

Whether you buy an uncirculated coin or a Brilliant Uncirculated coin, protect it from the elements and environment so you can admire its beauty for years to come.