Platinum coins offer a compelling blend of investment potential, rarity, and aesthetic beauty, making them an attractive choice for investors and collectors. Platinum’s unique properties, diverse industrial applications, and demand make them an appealing asset to add to your portfolio.

Reasons to Buy Platinum Coins

Platinum is a precious metal with unique properties that make it in demand across various industries. Many buy platinum coins for investment purposes and for their beautiful designs.

Value

There have been instances when platinum has surpassed gold in value. However, like all precious metals and commodities, the spot price of platinum is in a constant state of flux. Yet, it is worth noting that platinum has maintained a relatively stable price over the past few years. This stability can provide a sense of security to potential investors, especially during economic downturns when many choose to invest in platinum to safeguard their wealth.

Comparing relative values may help to consider the gold-to-platinum ratio. Currently, gold is at an all-time high; it would take about 2.3 ounces of platinum to buy one ounce of gold. While gold has traditionally held its value, platinum may be worth considering if you are looking to diversify.

Platinum may also be more affordable to patient investors who are looking for a lower-priced entry point into precious metals investing.

Industrial Demand

Platinum is resistant to corrosion, durable, and has hypoallergenic properties making it a valuable addition to the automotive, electronics, chemical processing, medical, and refining petroleum industries.

In terms of future uses, it is anticipated that growing interest in green technologies is expected to drive long-term demand for platinum. It is essential in several emerging technologies, particularly in the field of renewable energy. It is a key component in hydrogen fuel cells.

To a lesser degree, platinum is a popular choice for jewelry. It is attractive, durable, and has the unique property of being hypoallergenic. Usually, platinum-based jewelry is more costly than gold jewelry. The jewelry industry creates an additional demand for this silvery metal.

Investment

There have been moments in history when platinum boasted a higher spot value than gold. That is not the usual situation, but it has happened. In the past few years, platinum has held its value relatively well, making it a potentially good diversification metal for patient investors.

Other appealing factors for investors are that demand often increases when the economy is going well, and buyers are spending more money on items created using platinum, like cars and jewelry. Conversely, when consumers spend less, demand may decrease, lowering prices for opportunist long-term investors.

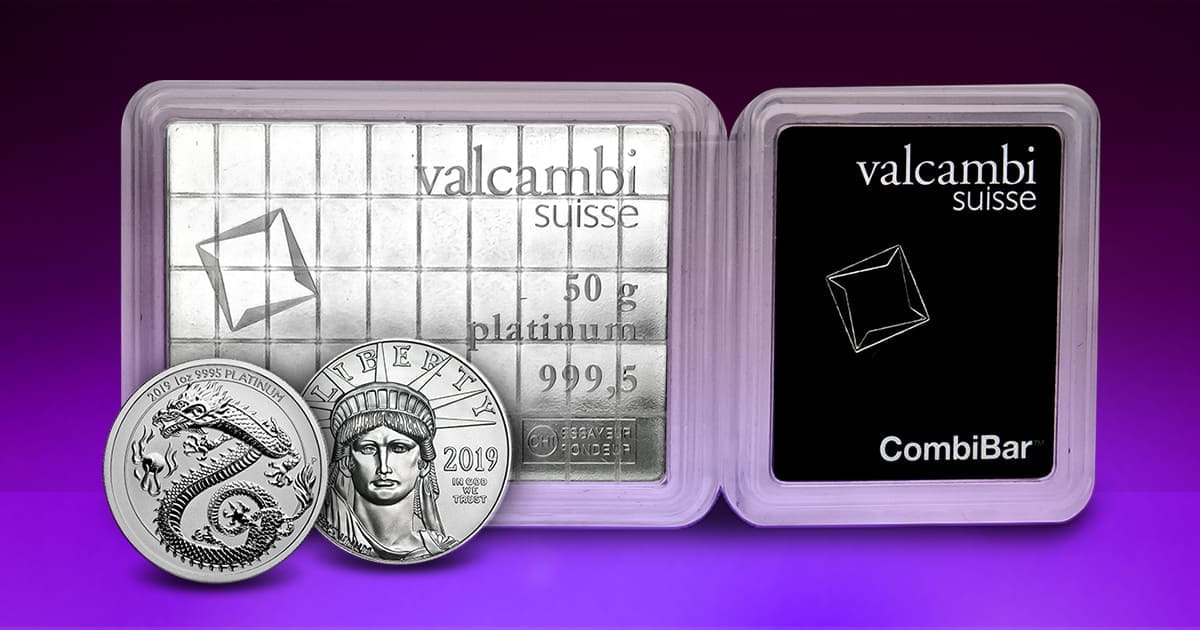

Popular Platinum Coins for Investors

Investors tend to lean towards bullion coins over collectibles. Many countries issue platinum coins. Some popular choices include,

- United States: American Eagles

- Canada: Maple Leafs

- Austria: Philharmonics

- United Kingdon: Britannias

- Australia: Kangaroos and Koalas

Attractive Designs: Platinum Coins

Many platinum coins are beautifully crafted and issued in limited quantities, adding a collectible appeal. While you may be familiar with American Eagles and Canadian Maples, you may not be familiar with some other notable collectible platinum coins.

The Queen’s Beasts: The series celebrates the ten heraldic statues that stood guard at the Queen’s coronation in 1953. Each beast represents the rich heraldic history of the United Kingdom and the monarchy.

Lunar Series: The Perth Mint Lunar Series has a new release yearly featuring the animal of that lunar year. The most popular coins are the Dragon and the Tiger.

Platinum IRAs

Another way to invest in platinum coins is via platinum IRAs. The platinum American Eagle coin is one coin that is eligible for platinum IRAs. According to the IRS (Internal Revenue Service), coins must have a minimum fineness of .9995 and be produced by an accredited mint. Your custodian should be able to help you select IRS-approved platinum products.

Platinum coins offer a compelling blend of investment potential, rarity, and aesthetic beauty, making them an attractive choice for investors and collectors. Platinum’s unique properties, diverse industrial applications, and demand ensure that it remains a valuable asset.