Silver coins are a great place to begin building an investment portfolio because they come in various finishes, such as Brilliant Uncirculated (BU) or Proof, and in a range of designs. Proof silver coins are ideal for investors because they often contain the same silver content and design as their bullion counterparts but are perfect for portfolios with high-quality, mirror-like finishes.

Investors often choose silver coins from sovereign mints due to their government backing and guaranteed silver content. There are numerous choices for investment-grade, sovereign mint silver coins for investors to choose. These are the top 10 silver coins for investment.

- American Silver Eagles

- Canadian Silver Maple Leafs

- British Silver Britannias

- Mexican Silver Libertads

- Somalian Silver Elephants

- Austrian Silver Philharmonics

- Morgan Silver Dollars

- 90% Silver ” Junk” Dimes

- Australian Silver Kangaroos

- Chinese Silver Pandas

1. American Silver Eagles

The American Silver Eagle is the official investment-grade silver bullion coin of the United States Mint. It is guaranteed for weight, content, and purity by the U.S. government. The American Silver Eagle consists of 1 oz of .999 fine silver with a face value of one dollar. Investors of Silver Eagles enjoy unparalleled recognition and liquidity with this particular investment.

The American Eagle program first debuted in 1986, with the Silver Eagle featuring an obverse design depicting the Walking Liberty design. The design was created by Adolph A. Weinman for the Walking Liberty Half Dollar in 1916. The original reverse design featured a heraldic eagle and shield with thirteen stars. The design was updated in 2021, celebrating 35 years of this iconic series. It now displays an eagle in flight adding an oak branch to a nest.

2. Canadian Silver Maple Leafs

The Canadian Silver Maple Leaf has great recognizability, featuring the iconic single maple leaf that is a powerful symbol of Canada. Since its introduction in 1988, the Silver Maple Leaf has consisted of 1 oz of .9999 fine silver – making them among the finest of all silver dollar-sized coins across the globe. The Silver Canadian Maple Leaf coin offers good liquidity and value.

Featuring the Royal Canadian Mint’s MintShield™ white spot reducing technology, this popular silver coin is unmatchable. The coin also features an added security measure with its unique design of the light diffracting pattern of radial lines. In addition, Canadian Mint silver coins carry the legacy of the Royal Canadian Mint, which has been operational for more than a century.

3. British Silver Britannias

Initially introduced in 1987, these famous British silver coins are the perfect depiction of British history, displaying a portrait of a more mature likeness of Queen Elizabeth II on the obverse and the Standing Britannia in a horse-drawn chariot on the reverse. The increased their purity from .958 fine to .999 fine silver in 2012.

The high silver content, along with the vast respect and recognizability commanded by The Royal Mint, makes Silver Britannias an excellent value with good potential for liquidity.

4. Mexican Silver Libertads

Struck by one of the oldest North American mints, la Casa de Moneda de Mexico, the Silver Mexican Libertad coin is one of the most famous silver bullion coins available today. Released in 1982, these silver coins consist of .999 fine silver and come in various sizes, including 1 oz, 1/2 oz, 1/4 oz, 1/10 oz and many more to fit any portfolio or budget.

The artwork featured on the Silver Libertad is both arrestingly beautiful and essential to the history of Mexico. Its legendary design and limited mintages make the Mexican Libertad silver coin a sought-after addition to any coin portfolio.

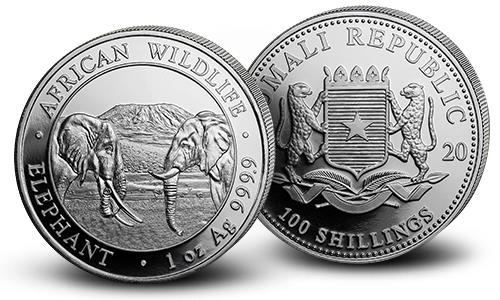

5. Somalian Silver Elephants

Somalian Silver Elephants are one of the most intriguing coins in the African Wildlife Coin Series, which celebrates the well-known fauna of Africa. In 2017, the Somalian Silver Elephant series expanded to include a variety of sizes, perfect for any budget or collection. It is now available in 1/10 oz, 1/4 oz, 1/2 oz, 1 oz, 2 oz, 5 oz, 10 oz and 1 kilo silver coins.

Since their release in 1999, Somalian Elephant silver coins have held enormous potential for return on investment. Particular issues of these coins, when graded as MS-70 by third-party grading services, have produced a return on investment of more than 300%. It is struck from .9999 silver and has the growth potential of any other respected silver coin.

6. Morgan Silver Dollars

Morgan Silver Dollars were minted from 1878 to 1904 and then again in 1921. These silver coins are struck from planchets comprised of 90% silver and 10% copper. Although particular Morgan Silver Dollars command enormous numismatic premiums, lower-quality coins from years with large mintages can be purchased just over the current silver spot price. 1921-dated Morgans in particular can typically be found at the lowest prices compared to other years.

Morgan Silver Dollars boast such wide recognition that they are extremely popular among silver collectors and investors.

7. Austrian Silver Philharmonics

First released in 2008, the Austrian Silver Philharmonic is the newest annual-release program on our list. Many believe that the Silver Philharmonic coin is a low-mintage coin that outshines even the Canadian Silver Maple Leaf in its beauty. The Philharmonic is the only silver coin denominated in euros, bearing a legal tender value of €1.5. Consisting of .999 fine silver, the Austrian Silver Philharmonic is perfect for any investor or music enthusiast.

The obverse of this Silver coin depicts the Golden Hall in Vienna, the site of the orchestra’s annual New Year’s Day concert. At the same time, the reverse features musical instruments from the Austrian Philharmonic Orchestra – the grand national treasure of Austria. Silver Philharmonics offer a great way to branch into European coins with reasonable premiums.

8. 90% “Junk” Silver Dimes

From 1837 to 1964, United States ten-cent pieces were made of 90% silver and 10% copper, just like the aforementioned Morgan Silver Dollar. Dimes, naturally, are smaller, and thus these contained less silver at approximately 0.0715 troy ounces per coin. Although some of these older dimes have become numismatic collectibles, those commonly called “junk” 90% Silver Dimes can be purchased by the bagful from reputable precious metals dealers, like APMEX.

9. Australian Silver Kangaroos

Since its introduction in 1993, the Australian Silver Kangaroo series from The Perth Mint has been a powerful symbol of Australia. Each Australian Silver Kangaroo iteration features a classic red kangaroo mid-bound in front of a stylized starburst.

An exceptional coin made from .9999 fine silver, the 1 oz Australian Silver Kangaroo is issued with a face value of AUD 1 and is considered highly collectible and generally liquid due to its notable mintage history and its fascinating, recognizable artwork. It is coveted among collectors and investors due to its purity and classic design.

10. Chinese Silver Pandas

The last silver coin on our list of top 10 silver coins for investment is the Chinese Silver Panda coin. The obverse of this popular silver coin features the Hall of Prayer for Good Harvest in the Temple of Heaven in Beijing, a great example of classic Chinese architecture. Each year, the series bears a new reverse image of the giant panda, a revered icon in China. Since its initial release in 1983, collectors and investors have looked forward to seeing the newest giant panda design featured on this famous silver coin.

The Silver Panda coins contain 1 ounce of .999 fine silver and are Chinese legal tender, boasting more limited mintages than many other bullion coins. Its unique size and low mintage make it an excellent addition to any bullion portfolio and one of the most exciting coins for silver investors.

Silver coins make excellent investment opportunities; for any questions regarding the eligibility of specific silver products in your investment portfolios, APMEX recommends consulting a financial advisor or professional.