Gold is prized as an investment for its stability and intrinsic value. Gold bonds are an intriguing financial instrument that blends the stability of bonds with the allure of gold investment. But what exactly are gold bonds?

Gold bonds are debt securities issued by governments or financial institutions backed by the physical gold they hold. Unlike physical gold investments, which require secure storage, and gold stocks, which are equity investments in gold-related companies, gold bonds provide a direct link to the value of gold with added layers of flexibility and security.

What are Bonds?

Bonds are loans issued by borrowers to investors. The borrower agrees to pay back the principal and interest at predetermined intervals until the bond matures. Governments, municipalities, corporations, and other institutions can issue bonds to fund projects or operations.

There are several variations of bonds, such as government, corporate, municipal, and zero-coupon bonds. Gold bonds are a specific category of bond investment notable for their backing by gold. They offer a unique blend of bond investment safety and gold investment appeal.

What are Gold Bonds?

Gold bonds are financial instruments representing an investor’s ownership of gold without holding the metal physically. These bonds are issued by a sovereign authority and denominated in units of gold. They typically come in the form of digital or paper certificates, with each bond representing a specific weight of gold. The certificate entitles them to a set amount of gold or its equivalent value at maturity. Investors receive periodic interest payments on their investment, and upon maturity, they are paid the equivalent value of the gold based on current market prices.

Gold bonds differ from traditional gold investments in several ways.

| Feature | Physical Gold | Gold Bonds |

| Storage and Security | Requires secure storage and is susceptible to theft and loss. | No need for physical storage; held electronically or in paper form, enhancing security. |

| Returns and Interest | Does not generate income unless sold; purely reliant on price appreciation. | Offers regular interest payments in addition to potential gains from price movements. |

| Tax Advantages | Often subject to higher tax rates and lacks specific investment-related tax benefits. | Often comes with tax benefits not available with physical gold. |

Gold bonds are an attractive option for investors looking to benefit from gold’s price movements without dealing with the logistical issues of storing physical gold. They serve as a hedge against inflation and currency fluctuations, much like physical gold investments. Still, they are easier to trade and may offer additional returns in the form of interest payments.

A prime example of gold bonds is the Sovereign Gold Bonds issued by the Reserve Bank of India (RBI). These bonds aim to reduce the demand for physical gold, limit imports, and manage the country’s financial resources more efficiently.

Sovereign Gold Bonds

Sovereign Gold Bonds (SGBs) are a special type of gold bond issued by the RBI on behalf of the Indian government. These bonds are intended to provide investors with an alternative to owning physical gold while contributing to the nation’s economic health by reducing physical gold imports. Key features of Sovereign Gold Bonds include:

- Denomination and Investment: SGBs are denominated in multiples of one gram of gold. Investors can buy a minimum of one gram, with a maximum purchase limit set per fiscal year for individuals and institutions.

- Interest Rates: Sovereign gold bonds offer a fixed interest rate, typically around 2.5% per annum, paid semi-annually. The interest is an additional income over the appreciation of the market value of gold.

- Maturity and Redemption: SGBs have a maturity period of eight years, with an option to redeem earlier after the fifth year on the interest payment date.

- Tax Benefits: Interest on SGBs is tax-free, and capital gains tax is exempt if the bond is held until maturity.

- Accessibility and Trading: SGBs are sold through banks, Stock Holding Corporation of India Limited (SHCIL), designated post offices, and recognized stock exchanges, making them widely accessible. They are also tradable on stock exchanges, offering liquidity before maturity.

These features make Sovereign Gold Bonds a desirable option for investors looking to benefit from the stable returns associated with gold investments and additional perks not commonly available with other forms of gold ownership.

The Role of the Reserve Bank of India

The Reserve Bank of India is essential in issuing and regulating Sovereign Gold Bonds, serving as the backbone of this financial instrument. As the central bank, the RBI issues these bonds on behalf of the Indian government and meticulously sets their terms.

The Reserve Bank of India also ensures the smooth operation of the Sovereign Gold Bond scheme by establishing stringent due diligence and compliance guidelines that banks and post offices must follow. This regulatory oversight helps maintain the transparency and trustworthiness of gold bonds as an investment. Additionally, by providing an alternative to physical gold, the RBI aims to decrease the high demand for physical gold in India, often leading to significant gold imports.

These efforts by the RBI offer individuals a secure investment route and align with broader economic strategies aimed at stabilizing the Indian economy and promoting digital financial transactions.

History of Gold Bonds

The concept of gold bonds is deeply rooted in financial history, reflecting the long-standing value of gold as a stable investment and reserve asset. The history of gold bonds intertwines with nations’ economic policies and financial strategies over the past centuries.

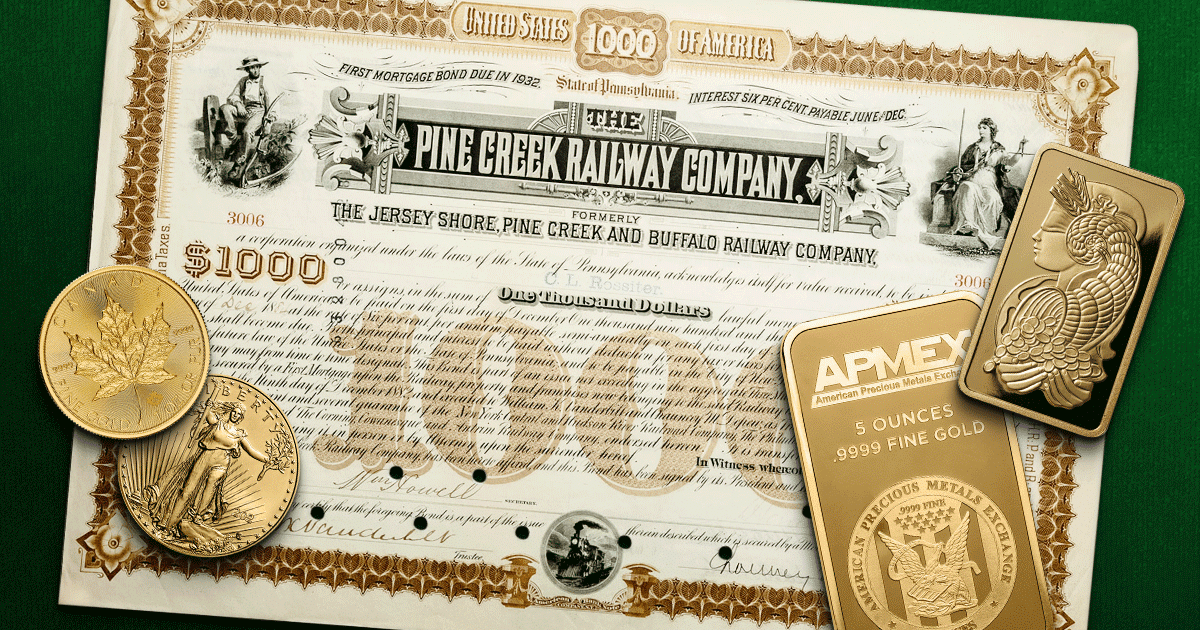

In the United States, gold bonds were commonly issued in the 19th and early 20th centuries, primarily by the federal government and railroads. These bonds were denominated in gold dollars and were meant to be repaid in gold coins. The Gold Standard was in place, and gold was a principal medium of exchange and store of value.

The issuance of gold bonds helped stabilize the currency and finance significant infrastructure projects, including the expansion of the railway system. The Gold Standard under which these bonds were issued ensured they were considered secure investments backed by the government’s physical gold reserves.

The use of gold bonds declined as countries moved away from the Gold Standard. In the U.S., the shift began with abandoning the Gold Standard during the Great Depression, culminating in President Nixon officially detaching the U.S. dollar from gold in 1971.

While traditional gold bonds have become rare, the concept has seen a resurgence with instruments like Sovereign Gold Bonds in India. These modern gold bonds no longer tie the currency to gold but still allow investors to benefit from the underlying value of gold.

The historical use of gold bonds in the U.S. provides a valuable perspective on the evolution of financial instruments and their impact on economic policy and investor behavior over time.

Investing in Gold Bonds

Gold bonds present a distinctive opportunity for investors seeking stability and growth potential. As financial instruments, these bonds allow individuals to invest in gold without physically holding the commodity. This form of investment taps into gold’s inherent value, offering a sophisticated way to diversify an investment portfolio.

Benefits of Investing in Gold Bonds

The primary benefits of investing in gold bonds include the security associated with gold, one of the less volatile commodities. Unlike physical gold, these bonds provide periodic interest payments, contributing an additional income stream for investors. This aspect particularly appeals to those looking for regular earnings from their investments. Additionally, certain gold bonds, like the Sovereign Gold Bonds in India, offer tax advantages that can significantly enhance the returns, making them an attractive option for tax-conscious investors.

Risks of Investing in Gold Bonds

However, gold bonds also come with their own set of risks. The price of gold fluctuates due to changes in global economic conditions, market trends, and geopolitical influences. This volatility can impact the bond’s value and the amount received upon its maturity. Gold bond interest rates are generally lower than more aggressive investment vehicles like equities or real estate. There is also a liquidity risk; despite being tradable on stock exchanges, these bonds may offer a different liquidity level than other forms of gold investments, which could pose challenges for investors needing to liquidate quickly.

Economic Impact of Gold Bonds

Gold bonds are significant in the broader economic landscape, particularly in heavily promoted countries like India. By providing an alternative to purchasing physical gold, these bonds help reduce the amount of gold that needs to be imported. This can substantially impact a nation’s trade balance, especially in countries like India, where gold is a major import item.

Reducing physical gold imports through investments in gold bonds helps stabilize the local currency and strengthens the economy’s overall health. Additionally, gold bonds mobilize domestic savings, channeling them into productive economic use instead of locking them in physical assets that do not contribute to economic growth. This redirection of funds helps fund government or private projects without directly raising taxes or reducing public spending.

Current Trends and Future Outlook

In recent years, the popularity of gold bonds has been rising, driven by increased market volatility and uncertainty in global economies. Investors are increasingly attracted to gold bonds due to their relative stability and conservative returns, especially in turbulent times. This trend might continue as more individuals and institutions seek safe-haven assets to protect against economic downturns.

As governments and central banks, like the Reserve Bank of India, continue to innovate and promote these instruments, we might expect further integration of gold bonds into mainstream investment portfolios. Moreover, technological advancements and digital platforms will likely make gold bonds more accessible to a broader audience, potentially increasing participation from younger investors more accustomed to online investments.