According to the latest Platinum Quarterly from the World Platinum Investment Council (WPIC), it is forecasted that the platinum market will experience a deficit in 2023. The expected deficit will be 303,000 ounces as the global platinum demand is expected to increase by 19% while the supply will only increase by 2%. These deficits are due, in part, to power outages and maintenance at the mines in top producing South Africa restricting supply as we move into 2023.

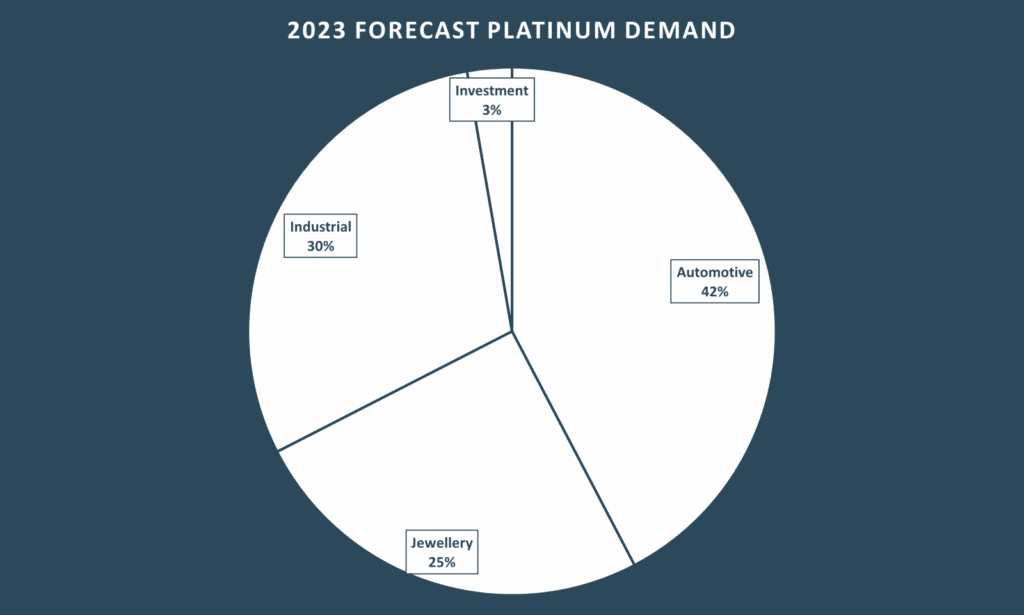

According to the WPIC, the increased demand in the industrial and automotive industries combined with the predicted supply shortages will create the platinum deficit in the new year. As displayed in the chart below, the forecasted demand by sector is 42% auto and 30% industrial – a considerably larger percentage than the predicted investment demand. With platinum seeing a prediction of only 3% retail investment demand, investor confidence must be high in the industrial and automotive categories moving into 2023 to consider investing in platinum. The outsized impact that auto and industrial demand play into platinum creates acute recession risk, however this risk may be offset by the increased government spending on the EV revolution.

The platinum deficit of 2023 is the result of multiple factors – the biggest being in the large increase in automotive demand. Platinum demand from the automotive industry is expected to increase due to stricter pollution regulations in many countries and increased enthusiasm for platinum-catalyzed diesel vehicles. Additionally, with government backing for the transition to electric vehicles, there is great potential found in this category in the new year. The growing substitution of platinum for palladium in the automotive industry is also expected to see a 12% increase in platinum demand. Supply constraints are coming from South African mine production due to lower ore grades and labor shortages as well as political risk in Zimbabwe.

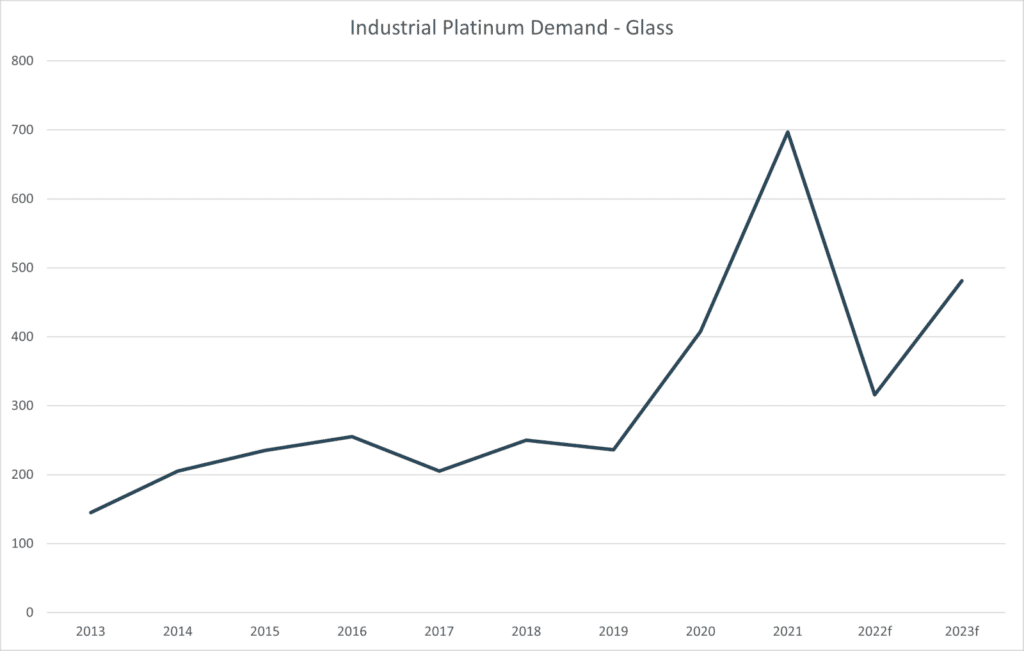

Industrial platinum demand was predicted to decline by a total of 14% in 2022 compared to the record levels of demand in 2021. Despite the decline, 2022 was on track to be the third strongest year for platinum industrial demand, according to the WPIC. The trend of high industrial demand is expected to continue into 2023, largely relating to the demand increase from glassmakers of 52%. Since 2020, industrial platinum demand for glass has skyrocketed and reached unbelievable highs – a trend shown in the chart below that does not appear to be stopping anytime soon. This increase in demand is creating what might be the second strongest year in industrial demand for platinum – second only to record demand in 2021.

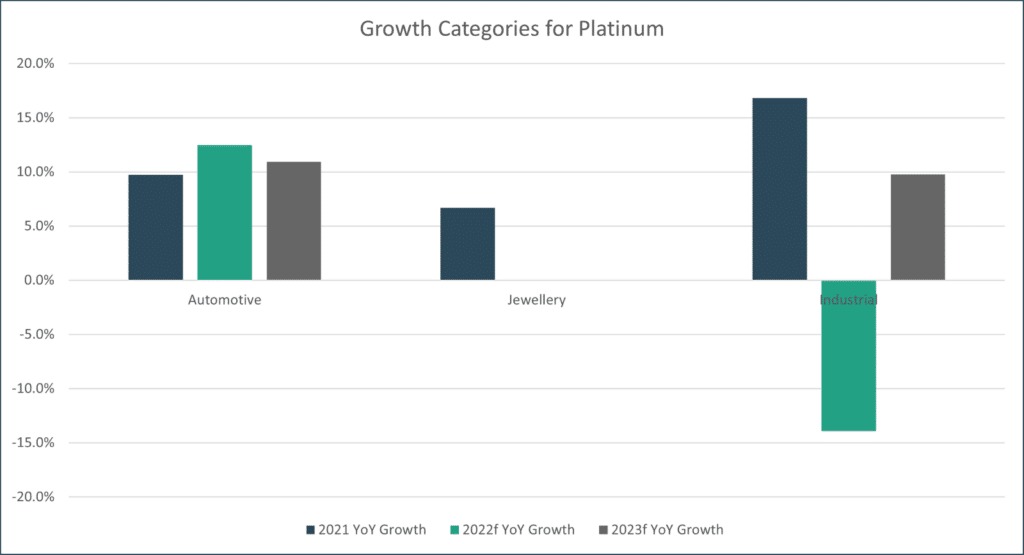

Considering these factors, platinum investments could potentially lead to better returns in 2023 given current expectations on deficits in this year. According to the growth categories for platinum, the automotive demand will remain high for the third year in a row while industrial demand will increase dramatically from last year – largely due to the increased glass demand as shown above. Platinum prices have increased since early 2021.

The chart below shows growth for platinum broken out by the major categories provided by WPIC data. In 2022 there was weaker demand for platinum in industrial sectors as compared to 2021. We are looking to see that rebound heading into 2023 to have a strong year for platinum prices. Automotive demand has held relatively steady in a growth capacity for the past few years, and we’re going to see watch that closely to see if the trend continues through 2023 as well. Jewlery demand is expected to remain flat to the prior year, but also bears monitoring as it consumes 25% of platinum demand.

This article is not intended as investment advice; please always do your own research before investing. It is important to weigh the potential benefits and risks associated with such investments before making any final decision. Consult a financial advisor for professional advice if necessary.