Finding accessible and reliable investment opportunities on a smaller budget is a difficult task for investors. If you’re looking for an affordable option, one type stands out: American Silver Eagles. These coins are a piece of American heritage and a smart way to diversify investment portfolios without breaking the bank.

American Silver Eagles

The American Silver Eagle, introduced in 1986, is the official silver bullion coin of the United States. It features a design that embodies American freedom and patriotism, with Adolph A. Weinman’s iconic Walking Liberty on the obverse and John Mercanti’s heraldic eagle on the reverse. Minted by the U.S. Mint, these coins contain one troy ounce of .999 pure silver, making them popular amongst investors and collectors for their beauty, purity, and government guarantee.

| American Silver Eagle | |

| First Year Produced | 1986 |

| Location Minted | West Point, San Fransisco, Philadelphia |

| Obverse Design | “Walking Liberty” by Adolph A. Weinman |

| Reverse Design (1986-2021) | Heraldic Eagle and Shield by John Mercanti |

| Reverse design (2021-Present) | Bald Eagle Landing on Branch by Emily Damstra |

| Silver Content | 1 troy oz (31.103 g) of .999 fine silver |

| Diameter | 40.6 mm |

| Thickness | 2.98 mm |

| Special Editions | Proof, Burnished, and certified versions |

By understanding the market of American Silver Eagles, investors can make informed decisions and leverage these coins’ potential to enhance their investment strategy.

Why Invest in American Silver Eagles?

American Silver Eagles are an affordable investment with the potential for significant returns. Building a collection of Silver Eagles while silver prices are down may help you make a considerable profit if they increase. You should consider buying American Silver Eagles as an investment for multiple reasons.

The Value of Silver

Silver maintains intrinsic value over time. It’s used in jewelry and silverware and has industrial applications in electronics, solar panels, and medical devices. This demand, coupled with silver’s finite supply, supports silver’s long-term value and makes it an appealing investment.

Cheaper than Gold

Investing in American Silver Eagles presents an attractive opportunity if you have a smaller budget and want to enter the precious metals market. Silver’s lower price point compared to gold makes it an accessible option for investors who may not have the capital required for gold investments but still wish to diversify their portfolio with tangible assets. This affordability is independent of the potential for growth and protection against inflation that precious metals offer, making American Silver Eagles an excellent choice for budget-conscious investors aiming for stability.

Historical Performance and Reliability

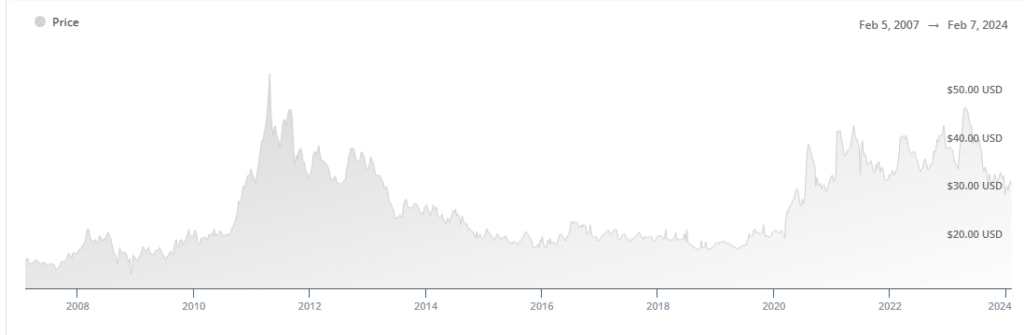

American Silver Eagles, first minted in 1986, have become one of the world’s leading silver bullion coins and a symbol of American financial stability. Their historical performance reflects mostly an increase in value, especially in times of economic uncertainty.

Although there are times the value of the American Silver Eagles has dropped, such as from 2012-2014, it has overall stayed steady throughout the coin’s history. This proves that while they might not fetch as high of a return as a different, more expensive or volatile investment, the Silver Eagles are a great store of wealth that serves as a hedge against hyperinflation.

We recently saw the market on Silver Eagles explode, raising premiums to over $10 per coin at times. While premiums are typically higher on American Silver Eagles than other silver bullion coins, this extreme increase was due to complications with the silver supply at the U.S. Mint. While it might not have presented the best buying opportunity for new investors, those who built a Silver Eagles collection over the years could sell their Eagles and receive great returns. The premiums on American Silver Eagles recently returned to normal, presenting another buying opportunity if you want to get into the game.

Benefits of Liquidity and Government Backing

One of the key advantages of American Silver Eagles is their liquidity. They are bought, sold, and traded almost anywhere in the world. Additionally, each coin is backed by the U.S. government for its weight, content, and purity, adding an extra layer of security.

Diversifying Your Portfolio

Incorporating American Silver Eagles into your investment portfolio enhances diversification and mitigates potential risks, serving as a hedge against stock market volatility and inflation. The enduring purchasing power of silver ensures that American Silver Eagles act as a safeguard for your wealth. These coins are a strategic choice for savvy investors aiming for affordable pieces for a well-rounded investment portfolio.

Collectability

The collectability of American Silver Eagles adds a unique layer of value beyond their silver content, making them an appealing investment for those with smaller budgets. Each coin is a work of art, capturing a piece of American heritage and numismatic beauty. This dual appeal ensures that American Silver Eagles hold their value well, often appreciating over time due to collector demand in addition to their intrinsic silver value. For budget-conscious investors, this means an opportunity to invest in an affordable tangible asset that has the potential for financial growth and possesses a collectable charm that could experience increased value in the numismatic market. If you acquire a collection of different years or types (proofs, certified), they could be worth more as a set than individual values combined.

These factors make American Silver Eagles a standout option as an affordable investment. Not only do they offer a hedge against inflation and currency devaluation, but they also provide an opportunity for portfolio diversification at affordable prices.

How to Start Investing in American Silver Eagles

Investing in American Silver Eagles can be both exciting and rewarding. As the most liquid silver bullion coin on the market, it is easy to find them for sale in many locations. However, this also makes it easy for counterfeits to enter the market, so be vigilant in your shopping when you decide to invest in Silver Eagles.

Basics of Buying American Silver Eagles

- Choosing Reputable Dealers: Buying from reputable dealers is crucial to avoid counterfeits and ensure you’re paying a fair price. Look for dealers with positive reviews, transparent pricing, and a track record of reliability. Dealers approved by the U.S. Mint are generally a safe bet.

- Understanding Premiums Over Spot Price: The spot price of silver is the current market price per ounce. However, American Silver Eagles sell for a premium over this price due to their collectibility, design, and minting costs. Understanding this premium and shopping for reasonable rates can help maximize your investment.

- Collecting Certain Types: American Silver Eagles have been in production since 1986, so there are numerous types and releases of the famous coin. Choose what kind of Silver Eagle you want to purchase, whether it is proof, burnished, or certified coins. All of these options vary in price based on rarity and condition.

Long-term Perspective and Analyzing Market Trends

Investing in silver, especially in the form of American Silver Eagles, is typically viewed as a long-term strategy. While the precious metals market can have its ups and downs, silver has consistently held its value over the long term, making it a prudent choice for those looking to preserve wealth for the future.

Various factors, including economic indicators, currency fluctuations, and industrial demand, can influence the value of silver. Utilize reputable financial news sources and market analysis to keep abreast of changes that might impact your investment. Investing requires an understanding of market dynamics to optimize entry and exit points.

Strategies for Buying Low

- Dollar-Cost Averaging involves buying a fixed amount of silver at regular intervals, regardless of the price. This strategy reduces the impact of volatility and lowers the average cost over time.

- Keeping a close eye on the market to find the best opportunity to buy silver when its price decreases. Pay attention to economic downturns or dips in silver prices to purchase American Silver Eagles at a lower cost.

Selling American Silver Eagles

Selling American Silver Eagles can be as straightforward as their purchase, with various avenues available to investors looking to liquidate their assets. Whether opting to sell back to reputable coin dealers, utilizing online marketplaces, or engaging with private collectors, it’s crucial to understand the current market value and demand for these coins. Research and timing can go a long way for those seeking to maximize returns.

Investing in American Silver Eagles requires market knowledge, strategic planning, and patience. As you consider incorporating these precious metals into your investment strategy, remember that timing, research, and a diversified portfolio are your keys to success.

Affordable and Secure

American Silver Eagles offer an affordable and accessible entry into precious metal investments, providing a tangible asset that diversifies your portfolio and protects against inflation. By understanding the intrinsic value of silver, how to start investing, and why American Silver Eagles are a good choice, you’re well on your way to making informed decisions about adding these coins to your investment mix.

If you want to deepen your knowledge and refine your investment strategies, exploring more detailed guides on precious metal investments or consulting with a financial advisor could be the next step. This approach will ensure that your investment decisions are well-informed and aligned with your long-term financial objectives.