Silver’s enduring allure lies not only in its historical significance but also in its contemporary relevance. Whether you are seeking a hedge against inflation, a means of diversifying your portfolio, or simply a tangible asset to hold, silver offers a compelling opportunity. With its dual appeal as both an industrial commodity and a store of value, this precious metal has gained significant traction among investors.

The Current Silver Market

Industrial demand remains a cornerstone of silver’s market strength. The metal’s unique properties, including its superior conductivity and reflectivity, make it indispensable in various industries. Notably, the growing renewable energy sector, particularly solar power, has emerged as a significant driver of silver consumption. The increasing adoption of electric vehicles and advancements in electronics further bolster this trend, ensuring a steady demand for silver in technological applications.

Silver is gaining ground as a hedge against inflation and economic instability, a trend bolstered by central banks worldwide adopting expansive monetary policies. This precious metal’s historic role as a store of value during financial turbulence adds to its allure, attracting a diverse group of investors, from retail buyers to institutional players.

Moreover, geopolitical tensions and trade uncertainties have amplified silver’s appeal as a safe-haven asset. As global markets grapple with the fallout from the pandemic and ongoing trade disputes, silver’s role in investment portfolios is becoming increasingly pronounced.

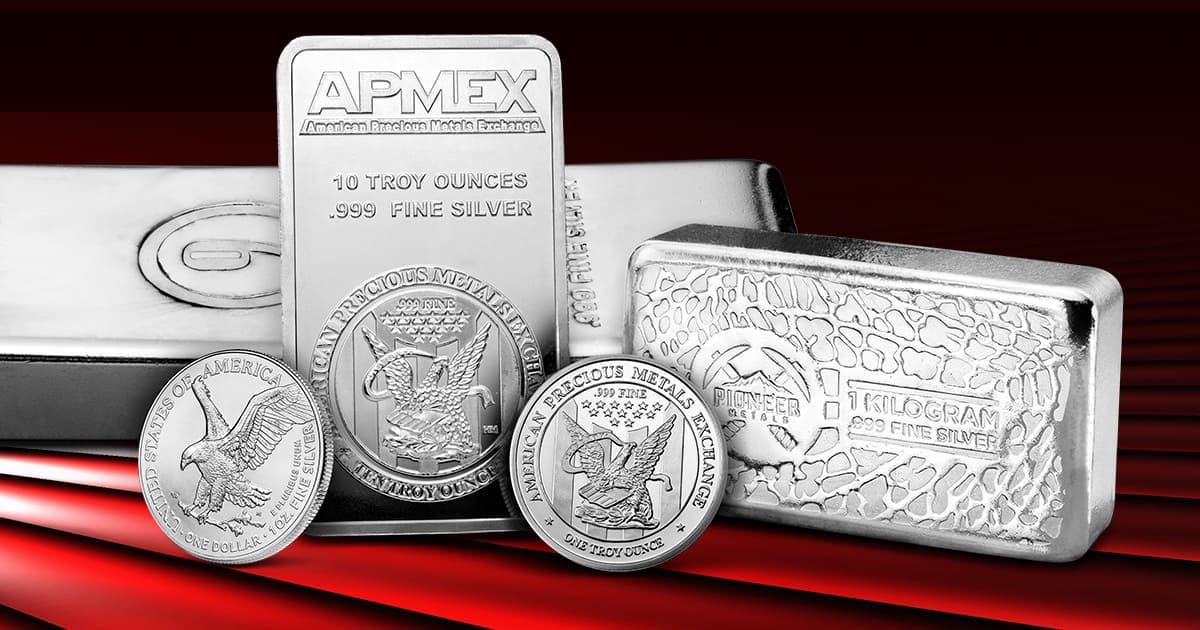

Physical Silver: Coins, Rounds, Bars, & Junk Silver

Each form of silver, whether coins, rounds, or bars, offers unique advantages and considerations, catering to different investment strategies and preferences.

Silver Coins

Coins feature intricate designs and are minted by government entities, ensuring quality and authenticity. Popular choices include the American Silver Eagle, Canadian Maple Leaf, and Austrian Philharmonic, each carrying legal tender status in its respective country.

Silver coins are highly liquid, making them easy to buy and sell. Their recognition and guaranteed purity, typically .999 fine silver, offer added security for investors. However, premiums are often comparatively higher than rounds or bars.

Silver Rounds

Silver rounds are privately minted pieces that do not carry legal tender status. They are often minted to the same purity standards as coins.

An advantage of silver rounds lies in their lower premiums. Without the added costs associated with government minting and design intricacy, rounds offer a cost-effective way to accumulate silver.

Silver Bars

For those looking to make substantial investments in silver, bars offer the most efficient way to purchase large quantities. The larger the silver bar, the lower the premium per ounce over the spot price, making bars the most economical option for bulk purchases.

Renowned refiners like Johnson Matthey, PAMP, and Engelhard produce silver bars that are widely recognized and trusted. These bars often come with serial numbers and assay certificates, ensuring their authenticity and purity.

Junk Silver

These are coins minted before 1965 in the United States that contain 90% silver. Junk silver coins, such as pre-1965 dimes, quarters, and half dollars, hold significant historical value. These coins circulated widely before the shift to copper-nickel alloys, making them readily recognizable and trusted.

Unlike collector’s items, junk silver coins are valued primarily for their metal content, allowing them to be bought and sold based on their silver weight, often with lower premiums compared to other forms of silver.

Buying Physical Silver

When investing in physical silver, it’s essential to buy from reputable dealers to ensure authenticity and fair pricing. Researching dealer reviews, understanding the premiums involved, and being aware of market conditions can help investors make informed decisions. Additionally, considering storage options—whether through private vaults, bank safety deposit boxes, or insured home storage—adds an extra layer of security to the investment.

Choosing the Right Dealer

The first step in buying physical silver is selecting a reputable dealer. The market has options from local coin shops to established online retailers. Reputable dealers guarantee the authenticity and quality of the silver. It’s advisable to conduct thorough research, read customer reviews, and check ratings. Transparency in pricing, including premiums over the spot price of silver, is a sign of a trustworthy dealer.

Understanding Premiums and Pricing

The premium is the amount charged over the current spot price of silver, reflecting manufacturing costs, distribution, and dealer margins. Premiums vary based on the type of silver—coins generally carry higher premiums than bars due to their intricate designs and minting costs. Conversely, rounds often come with lower premiums, making them a cost-effective choice for those focused purely on silver content.

Storage Options

Proper storage protects your investment from theft and damage and maintains its condition and resale value. Options for storage include home safes, bank safety deposit boxes, and professional vault services. Home safes offer immediate access but may require robust security measures. Bank safety deposit boxes provide security but may come with accessibility constraints. Professional vault services, often provided by dealers or third-party companies, offer high security and insurance but at an additional cost.

Which method of storage you employ may depend on the volume of silver you need to store. A few coins or tubes can easily be stored in a standard home safe. If you choose to store volumes of silver within your property, only discuss your cache on a “need to know” basis. Volumes of silver may be best stored in a secure storage facility. However, you would not have 24-hour access.

Transaction Process, Verification, and Shipping

When purchasing, ensure you receive all necessary documentation, including receipts and certificates of authenticity, particularly for high-value items. This documentation is vital for future resale and verification purposes. In addition, consider the logistics of shipping and handling, especially for online purchases. Insured shipping options protect against loss or damage during transit.

When to Buy

The best time to buy silver is always something investors are trying to time. Timing is critical to maximizing returns when investing in silver. Like all commodities, silver prices are subject to volatility, influenced by factors ranging from macroeconomic trends to geopolitical events. Understanding when to buy silver can significantly impact the profitability of your investment.

One of the primary indicators for buying silver is the state of the global economy. During periods of economic uncertainty, such as recessions or financial crises, investors often flock to safe-haven assets like silver. Historically, silver prices have surged during times of market instability, as it provides a hedge against inflation and currency devaluation. Monitoring economic indicators, such as interest rates, inflation rates, and unemployment figures, can provide insights into the optimal buying times.

Another critical factor is market sentiment, which geopolitical events, shifts in investor confidence, and changes in market regulations may influence. For example, political instability or significant policy shifts in major economies can lead to a surge in demand for silver as a protective asset. Monitoring news and market analyses can help investors gauge sentiment and make timely decisions.

As you become a more experienced buyer and seller of silver, you will learn more about optimal buying times.

Timing the Market

Ultimately, deciding when to buy silver should align with a broader investment strategy. While timing the market can enhance returns, it’s equally important to view silver as a long-term component of a diversified portfolio. Consistent, periodic purchases, a strategy known as dollar-cost averaging, can mitigate the risks of market timing and smooth out price volatility over time. This approach ensures that investors build their holdings steadily, regardless of short-term price fluctuations.

Buying silver at the right time involves a blend of economic insight, market awareness, and strategic planning. Investors can make informed decisions by staying informed about global economic conditions, recognizing cyclical trends, and employing technical analysis. Coupled with a long-term perspective and diversification strategy, these practices may help navigate the complexities of the silver market, ensuring a resilient and potentially profitable investment.