Discover essential insights on selling your gold, including optimal timing and reputable buyers. Gain valuable knowledge on popular gold products and learn how to accurately calculate expected prices.

Determining the optimal moment to sell your gold combines personal choice and financial strategy.

ONE: Deciding When to Sell Gold

For investors aiming to maximize returns, regularly checking our spot price page for daily updates can be a valuable strategy. If your gold has been inherited or acquired in a non-investment context, consider the emotional attachment and whether it’s time to let go.

Primarily, individuals sell gold to liquidate investments, whether for significant expenses like purchasing a home or funding education or for more immediate needs such as bills. Some may opt to diversify their investments or indulge in personal splurges.

Regardless of the motive, the right moment to sell is when you decide it is. Common reasons for selling gold include:

- Reallocating investments.

- Covering educational expenses.

- Funding significant purchases like homes or vehicles.

- Meeting immediate financial needs.

- Exchanging for other metals, like bullion or numismatic/semi-numismatic items.

TWO: Know Your Gold

To help avoid being taken advantage of by opportunistic buyers, you must understand the value of the gold you hold.

Here is how some common gold items compare:

Bullion vs Collectibles

Bullion refers to precious metals in their raw, refined form, valued primarily based on weight and purity. Collectible coins or items possess additional value due to factors like rarity, historical significance, or artistic design.

Examples:

Bullion: Gold Bars and Rounds

Collectibles: Gold Lunar Coins

Sovereign Mint vs Private Mint

Sovereign mints are government-owned facilities that produce legal tender coins with guaranteed purity and weight. Private mints are privately owned companies that manufacture bullion and commemorative items, often with unique designs and varying levels of quality assurance.

Examples:

Sovereign Mint: Gold American Eagles

Private Mint: Engelhard Mint Gold Rounds

Gold Bars vs Coins

Gold bars are typically larger, rectangular-shaped ingots of varying weights and purities, favored by investors seeking maximum gold content and lower premiums per ounce. Coins are smaller, circular pieces minted by government mints, often featuring intricate designs and historical significance. While coins may carry higher premiums due to collectibility and craftsmanship, they offer greater liquidity and divisibility for smaller transactions.

Examples:

Gold Bars: Credit Suisse Gold Bars

Gold Coins: Austrian Gold Philharmonic Coins

Good to Know: Bid Price vs Ask Price

Bid Price: The price at which a dealer is willing to buy your product.

Ask Price: The price at which a dealer offers to sell the same product.

THREE: Most Popular Types of Gold to Sell

We have assembled a list highlighting some of the most popular bullion products commonly sold back to dealers. If you are selling these types of coins, you have a relatively good chance of being able to sell them.

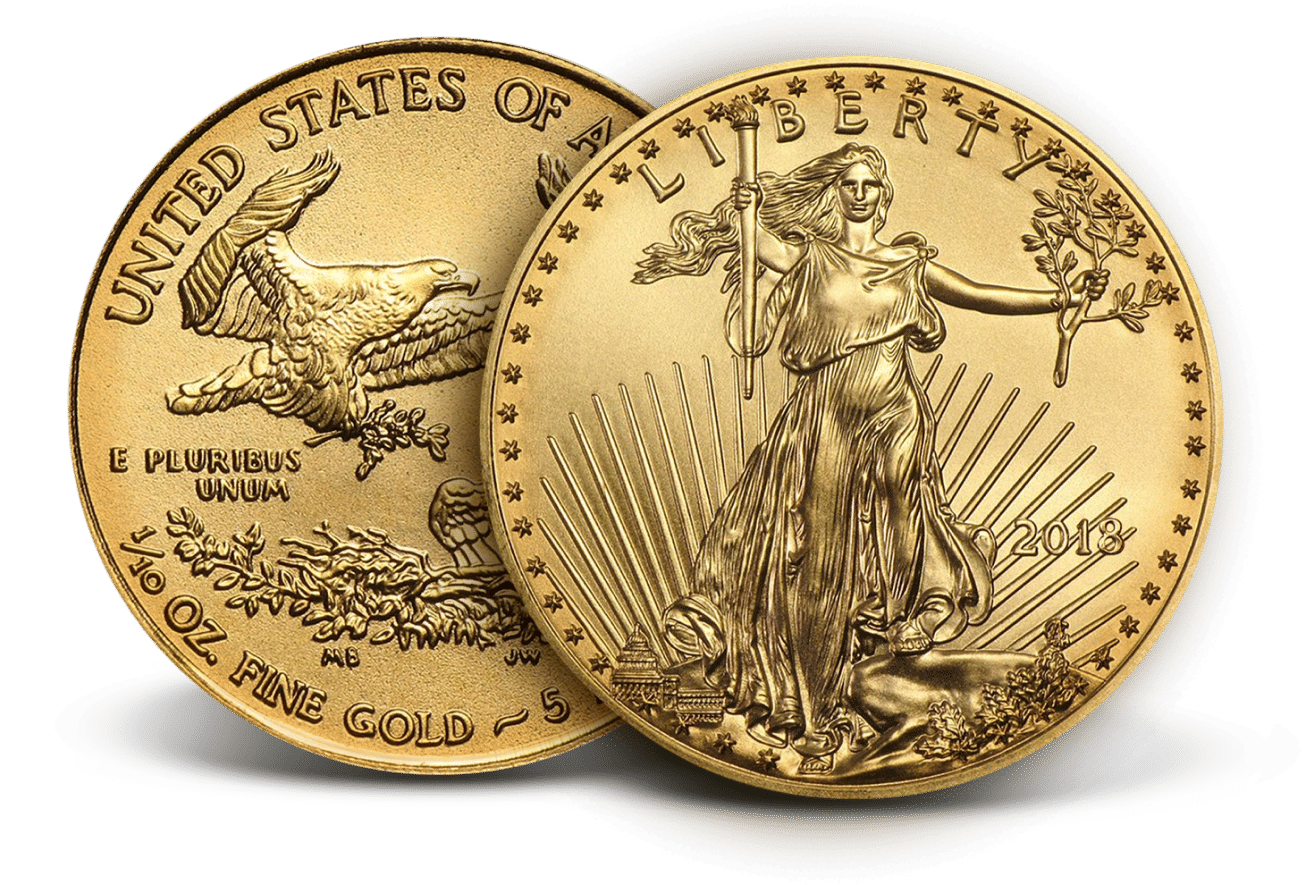

Gold American Eagles

The American Eagle coin come in a variety of denominations, designs and metals. American Eagles coins are produced by the U.S. Mint. Two American icons, the eagle, an unwavering representation of the United States, and Lady Liberty, have appeared on American Eagles since their first minting in 1986. The Gold Eagle takes its design from the 1907 Saint-Gaudens Gold Double Eagle.

Gold Buffalo Coins

The Gold Buffalo coin is based on the 1913 Buffalo Nickel designed by famed sculptor James Earle Fraser. This classic design celebrates Native American tribes and the majestic buffalo. The Gold Buffalo coin was the U.S. Mint’s first 1 oz gold coin to contain .9999 fine gold and has been popular since its introduction in 2006.

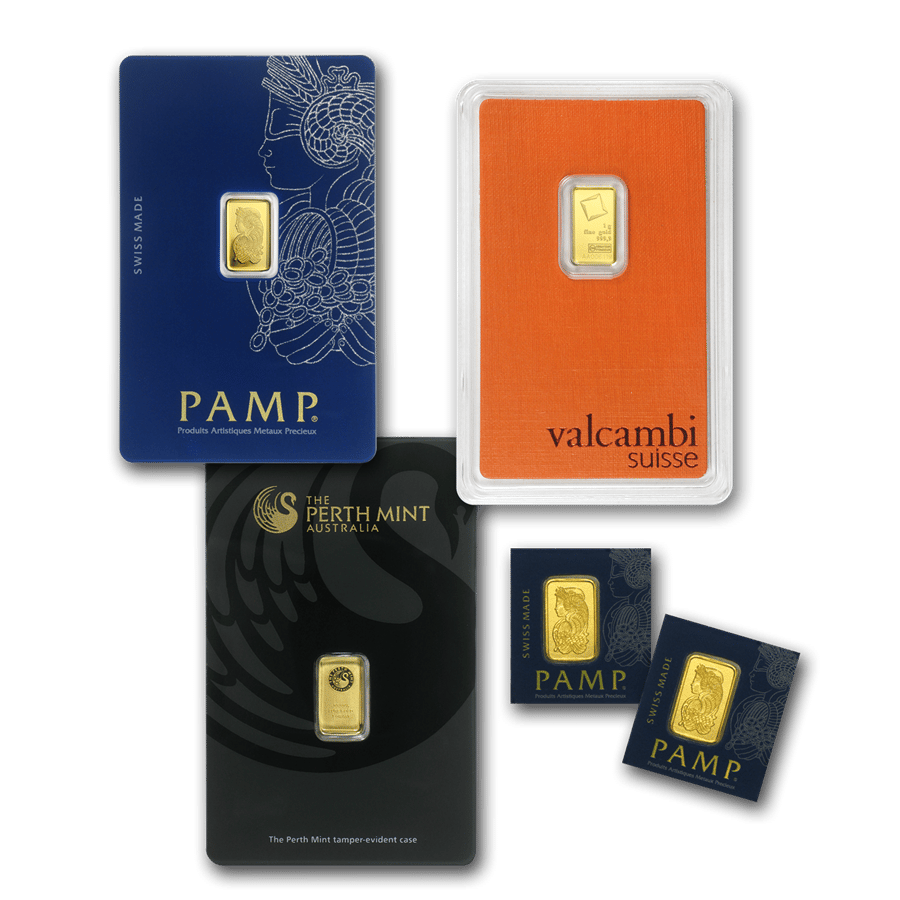

Golds Bars

Gold bars generally match sovereign coins in content and purity but cost less over gold spot price than gold coins because they’re usually minted privately. Each gold bar is stamped with its exact gold weight, fineness, and a serial number for added security.

Gram Gold Pieces

Gram Gold pieces, whether rounds, bars or coins, are easier to trade and barter with than full troy ounce sizes. They were also easier to obtain and certainly more affordable. Many refiners create gram gold pieces as an easy way for both investors to begin or add to a gold collection.

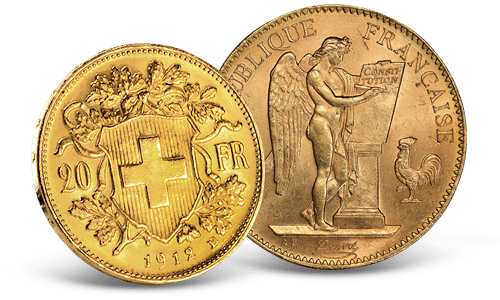

European Gold Coins

European Gold coins can be purchased stateside, but collectors may have obtained them while overseas. These are common to soldiers or contractors who were stationed overseas and bought or obtained as a memento. They were used as currency from the 1800s through the 1930s, so many types of European gold have made it into family histories, passed down from generation to generation.

FOUR: Find a Trusted Buyer

Once you know your gold, you must decide where to sell it. You’ll want to find a reputable, trusted online dealer, like APMEX.

You might wonder if the most convenient place to go is a pawn shop or a local coin shop. It has the benefit of being able to talk to someone in person and to walk out with a check that day. However, they usually pay less, and they may try intimidating you into accepting a lower price than your precious metals are worth.

FIVE: Consider Selling Your Gold to APMEX

Online Precious Metals Dealers, like APMEX, offer better prices than pawn shops or coin shops. Over the last 20 years, we’ve purchased over $1 billion in precious metals from people like you.

You can avoid the high-pressure tactics and aggressive employees typical of brick-and-mortar dealers by selling to us.

Selling your Gold to APMEX is easy and fast. We’ve entirely reinvented and modernized the buying process.

Here’s how it works:

- Create a free account online or give us a call.

Our friendly, no-pressure APMEX team will even help you identify products if you don’t know what you’re holding. - Lock in your price.

Once you have determined the products you want to sell, you will be quoted a price you can lock in immediately. - Ship your product.

We’ll send you all packing instructions and shipping labels to download and print. Pack your gold products and drop it off at UPS. - Get verification.

APMEX will authenticate each item, verified by members of the numismatic (coin experts) team. - Get your money.

Our 1-Day Guarantee means you’ll be paid in 1 business day from the time we validate your products (some restrictions apply).

Request a Quote

We make it easy to sell your gold, from locking in your price to getting paid. Start the process today by requesting a quote online or calling us. The quicker you decide to sell, the quicker you can get paid.