Are the Coins at APMEX Graded by CAC?

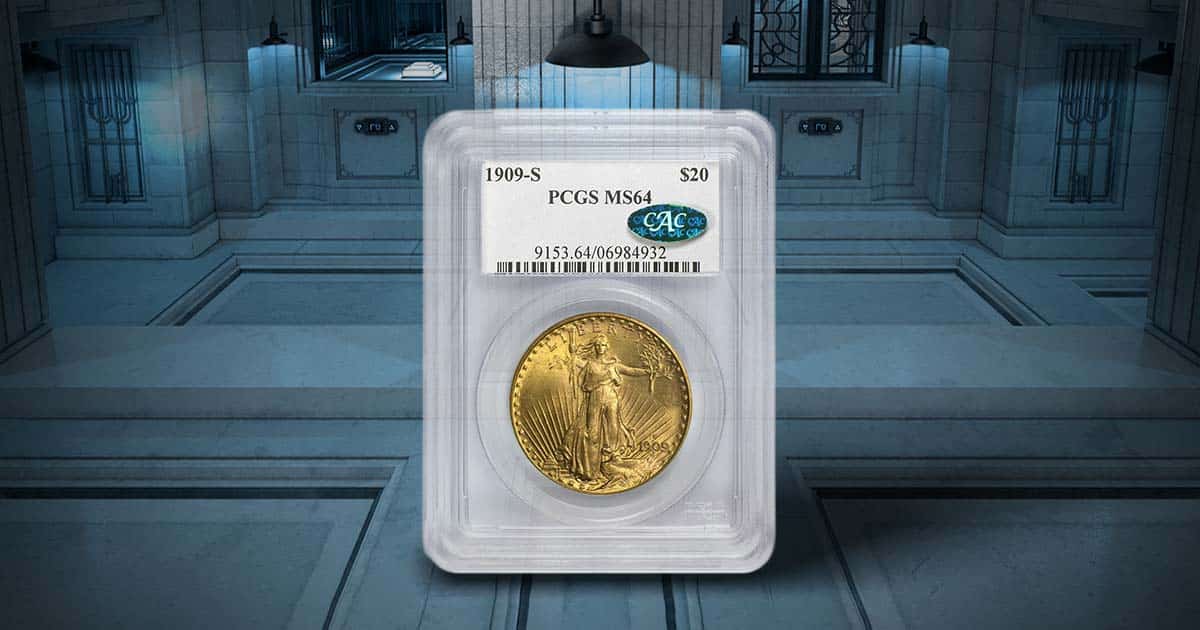

We carry a wide selection of coins and currency at APMEX. This includes many coins graded by Professional Coin Grading Services (PCGS) and the Numismatic Guaranty Company (NGC) that have been certified by the Certified Acceptance Corporation.

The Certified Acceptance Corporation (CAC) was founded by members of the numismatic world who saw a need for higher standards of grading. The CAC verifies coins that have already been graded and rewards those who meet their quality and authenticity standards with a CAC hologram sticker.

Are All Coins Sold by APMEX CAC Certified?

APMEX offers a wealth of choices at a competitive price, so every coin collector can find coins and collectibles within their budget.

The Certified Acceptance Corporation only verifies coins already graded by grading organizations like PCGS and NGC. While we proudly carry many coins certified by major grading organizations, we also offer ungraded coins of nearly every variety and type.

Why Would I Want to Buy Ungraded Coins?

Some collectors want to buy raw coins. Raw coins are less expensive than graded coins.

Buying ungraded coins allows collectors on a budget to afford coins that could be cost-prohibitive in higher grades. Some numismatists seek out ungraded coins that display high eye appeal, hoping to sell them for a handsome profit after grading.

Finally, some collectors may simply enjoy the beauty and gleam of coins displayed in a specific holder or presentation case.

Whether your interest is in NGC-Graded Morgan dollars or in ungraded America the Beautiful quarters, APMEX has what your collection is missing.