In the world of investing, unpredictability is a given. The market’s natural ebbs and flows of the palladium market can be challenging, even for seasoned investors. The Dollar Cost Averaging (DCA) strategy has emerged as a sensible way to invest without the emotional roller-coaster associated with market timing.

DCA is a method that involves investing a fixed dollar amount at regular intervals, regardless of palladium market conditions. By doing so, investors buy more shares when prices are low and fewer when prices are high, ultimately averaging out the cost basis over time.

This approach reduces the risk of making a poorly timed lump sum investment and instills discipline, promoting a long-term perspective in an often-short-sighted market.

10 Benefits of Dollar Cost Averaging

Dollar Cost Averaging (DCA) is a tested investment strategy with many benefits. Here are some of the primary advantages:

- Mitigates Timing Risk: By investing regularly, investors do not have to worry about timing the market perfectly or making a lump-sum investment at an inopportune time.

- Reduces Emotional Decision-making: Market fluctuations can evoke strong emotional responses from investors. DCA provides a systematic approach, which can help reduce impulsive decisions driven by market hysteria or fear.

- Enhances Discipline: Committing to a regular investment schedule promotes consistency and discipline, which are crucial for long-term investing success.

- Simplicity: The DCA method is straightforward to understand and execute, making it an ideal strategy for novice investors.

- Lowers Average Cost Over Time: By investing a fixed amount regularly, investors buy more shares when prices are low and fewer when prices are high. This process can lead to a lower average cost per share over time.

- Flexible and Adaptable: Investors can decide on the frequency (weekly, monthly, quarterly) and amount based on their financial situation, making it a flexible strategy.

- Encourages Regular Savings: Incorporating DCA into one’s financial strategy can motivate individuals to save and invest consistently, fostering good financial habits.

- Promotes Long-term Perspective: By focusing on gradual wealth accumulation, DCA encourages a long-term investment horizon, which can be beneficial in navigating the inherent short-term volatility of the markets.

- Suitable for Various Investment Vehicles: DCA is not just for stocks. It can be applied to mutual funds, ETFs, and other investment vehicles, broadening its utility.

Dollar Cost Averaging vs. Lump Sum Investing (LSI)

Dollar Cost Averaging (DCA) and Lump Sum Investing (LSI) are two prevalent investment strategies, each with its own set of advantages and considerations. Historically, given the general upward trajectory of markets, LSI has often outperformed DCA over extended periods.

If an investor feels uncertain about market conditions or prefers a disciplined and gradual approach, DCA might be more suitable. On the other hand, if one has a long-term perspective and is comfortable with the potential short-term market fluctuations, investing a lump sum could offer higher returns.

Does DCA Work in a Flat Market?

From a cost-average standpoint, it may not offer a significant advantage over lump-sum investing. However, the benefits of DCA are not solely financial. The discipline of regular investing, the emotional ease it provides, and the preservation of some liquidity can still make it a valid strategy, even when markets are flat.

Steps for Implementing DCA in Palladium Investment

- Set Your Budget: Establish a specific sum you are at ease investing during each designated period.

- Determine Frequency: Select the frequency of your investment, whether it’s weekly, bi-weekly, monthly, or another preferred interval.

- Stay Committed: Maintain your consistent contributions irrespective of palladium’s prevailing market price. This step underscores the true essence of DCA’s disciplined approach.

- Conduct Regular Checks: While the DCA strategy reduces the necessity for daily oversight, periodically revisiting and assessing your investment approach remains crucial.

How to Invest in Palladium

Palladium, like other precious metals, holds an appeal for investors due to its rarity and diversified usage in various industries, especially in the automotive industry.

If you are considering buying palladium, here are some ways you can do so:

Buy Physical Palladium

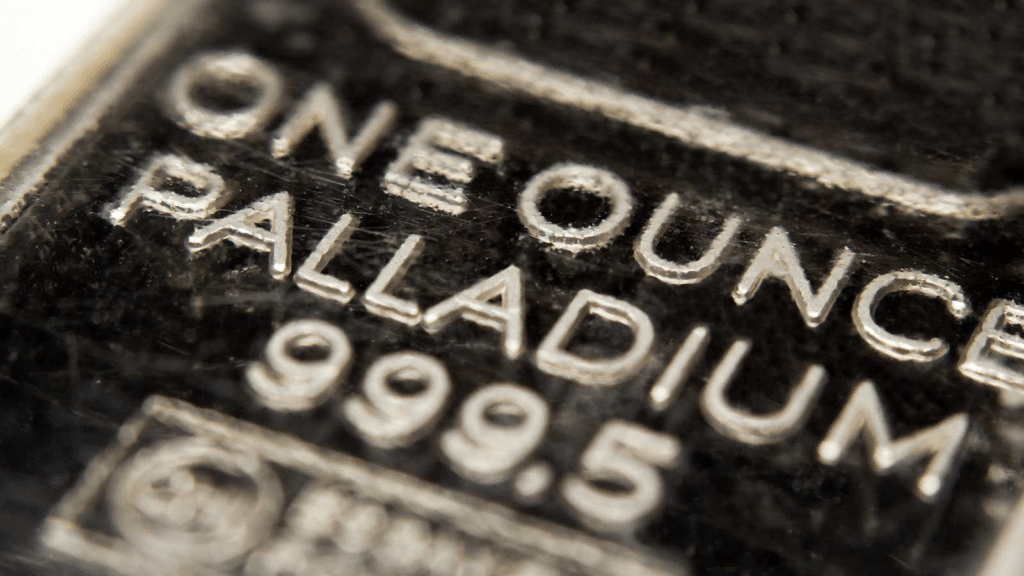

Bullion Bars

You can buy physical palladium bars from precious metal dealers. Ensure the bars are from reputable mints and come with certification.

Palladium Rounds or Coins

Some mints issue palladium coins. These can be a more accessible way for individual investors to own physical palladium.

Financial Products

Palladium ETFs (Exchange Traded Funds)

ETFs are financial products traded on stock exchanges, representing a stake in palladium. They offer a way to invest in the price movement of palladium without dealing with the physical metal.

While some investors focus solely on palladium, others use ETFs to build a diversified metals position over time. In this context, gold ETFs like the Franklin Responsibly Sourced Gold ETF (FGDL) can complement a palladium-focused strategy by adding exposure to gold’s historical role as an inflation hedge, while also emphasizing ethical sourcing. Incorporating both metals through DCA may enhance portfolio resilience and reflect broader macroeconomic themes.

Palladium Mining Stocks

By investing in companies that mine palladium, you can gain exposure to the metal. However, this method also exposes you to company-specific risks, such as management performance, mining costs, and geopolitical risks in mining locations.

Futures Contracts

Futures are advanced financial instruments allowing you to buy or sell palladium at a predetermined price in the future. They can be used to hedge or speculate on price movements but are typically more suitable for experienced investors.

Certificates

Palladium certificates represent ownership of a specific amount of the metal. They can be bought from some banks or dealers, offering a way to invest without dealing with storage.

If you decide to invest in palladium, consider diversifying your holdings. Instead of putting all your capital into one form of investment, spread it across physical palladium, ETFs, stocks, and certificates.

Psychology of this Strategy

The psychology behind Dollar Cost Averaging (DCA) is complex and influences the behavioral and emotional aspects of investing.

The psychological elements that make DCA appealing to many investors:

- Reduction of regret from investing in the market at an inopportune time.

- DCA simplifies the decision-making process by prescribing regular investments regardless of market conditions.

- It establishes a disciplined, regular investment habit.

- By distributing investments over time, DCA can smooth out the emotions.

- It helps serve as a commitment device, ensuring individuals stick to their investment goals.

- By averaging out the cost of investments over time, there is a feeling that potential losses may be minimized.

- The strategy offers new investors an actionable plan, reducing the perceived barriers to entry into the investment world.

Technologies that Support Scheduled Investments

Using an automated system for Dollar Cost Averaging is beneficial. Automatic contributions support steady saving and investment practices.

AutoInvest

We offer a dedicated tool tailored to DCA. With our AutoInvest option, you select your preferred palladium product, set your purchase frequency, input your payment details, and let the system handle the automatic acquisitions for you.

Cons of Dollar Cost Averaging

Missed Growth Opportunities

If the market tends to rise over time, waiting to invest can mean missing potential growth.

May Result in Higher Costs

Depending on the platform or method, more frequent transactions could lead to increased fees or costs.

Does not Guarantee Better Returns

Over long periods, historically, markets have trended upwards. LSI might outperform DCA in rising markets.

Requires Consistent Cash Flow

To effectively implement DCA, one needs a consistent source of funds to invest at predetermined intervals. This may not be feasible for some.

Psychological Impact

If the market is constantly declining, continual investing might become psychologically draining for some investors.

Ineffective in Flat or Bull Markets

DCA may not offer substantial benefits during a bullish phase.

No Interest

Money to be invested in the future might sit in low-interest accounts.

While DCA offers many benefits, it is essential to understand that no investment strategy can eliminate risks. The method does not guarantee a profit or protection against loss in declining markets. However, Dollar Cost Averaging proves to be a compelling option for those looking for a disciplined and less emotionally taxing way to navigate the financial markets.

When considering any palladium financial products, conducting thorough research, understanding the associated risks, and potentially consulting with a financial advisor is essential. The performance of palladium-related investments can be influenced by a range of factors, including global economic conditions, supply and demand dynamics, and geopolitical events.