What is Bullion?

Bullion refers to Precious Metals in bulk form, valued by weight. In popular culture, we Gold or Silver bullion usually appears as bars or ingots,

Whether you are a novice or experienced investor, the vast selection available can make buying bullion an intimidating experience. As you make decisions on your specific bullion needs, take the opportunity to explore our Knowledge Center and learn about the types of bullion bars, coins, or rounds available.

Bullion represents precious metals in their purest, high-value forms, typically measured by weight and purity. Whether you’re a first-time buyer or an experienced investor, understanding bullion is crucial to making wise investment choices. Bullion comes from various public and private global mints, highlighting its universal appeal and significance in preserving wealth. This section of our Knowledge Center makes navigating the bullion market simple and informative, helping you explore different metals, forms, and factors influencing their value.

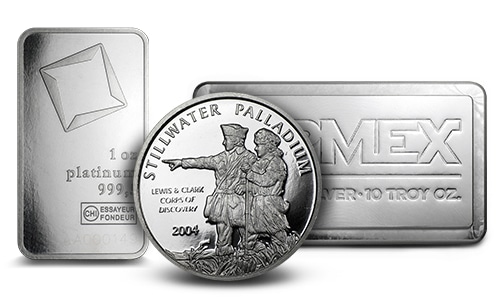

Bullion refers to bulk forms of precious metals, primarily gold, silver, platinum, and palladium. Unlike numismatic coins, which carry additional collectible value, bullion is valued primarily for its metal content and weight. Gold and silver bars and coins are popular types, but the world of bullion also includes unique forms like rounds, shaped pieces, or hand-poured silver.

Bullion comes in multiple shapes, sizes, and metals, making it adaptable to various investment strategies. Traditional forms include gold and silver bars and coins, but bullion also encompasses some platinum and palladium products. Bullion sizes range from grams and fractional ounces to large kilogram bars, allowing investors to tailor their purchases to fit their budget and goals.

Bullion coins are a popular choice, celebrated for their craftsmanship and value. Coins like the American Eagle, Canadian Maple Leaf, British Britannia, and Australian Kangaroo are internationally recognized, enhancing their liquidity and appeal. Each of these bullion types reflects its nation’s artistry and heritage, making them a store of value and a piece of cultural significance.

Investors turn to bullion for various reasons, primarily as a store of value and a hedge against economic uncertainty. Gold and silver have held their value over centuries, making them ideal for those looking to preserve wealth over the long term. Platinum and palladium, while less traditional, offer unique opportunities due to their industrial applications and rarity, providing additional layers of diversification. Many see bullion as a tangible asset in a world of fluctuating paper currencies, serving as a protective barrier in times of inflation or market volatility.

The value of bullion is primarily due to the intrinsic value of the metal and is determined by the current spot price. Global supply and demand, economic conditions, geopolitical events, and currency fluctuations drive precious metal prices. For example, silver’s value is often influenced by its industrial uses, while gold’s price responds to interest rates and inflation. Knowing how these factors interplay can enhance your ability to make well-timed, informed investments in bullion. Each form of bullion also carries a premium over spot, which varies depending on the type. Bars, for instance, typically have a lower premium than popular coins such as the American Eagle series.

The journey into bullion investment is exciting, with a range of options suitable for every level of investor. Our Knowledge Center offers in-depth articles on gold, silver, platinum, and palladium bullion, guiding you through each type and helping you find the best fit for your portfolio. Whether you’re looking to start small or invest in larger quantities, our resources provide the insights needed to make confident decisions. Start exploring today and see how bullion can be a valuable asset in your investment strategy.

Gold, Silver, Platinum, and Palladium all come in various forms and sizes to create a variety of options for investors and collectors.

Since the U.S. Mint’s American Eagle program began in 1986, Gold and Silver Eagles have remained a popular choice among both investors and collectors