For individuals looking to invest in bullion coins, Silver American Eagles are a dependable and highly sought-after option. This investment provides incomparable security thanks to its worldwide acclaim and assurance from the U.S. government – making it an ideal option for stackers and investors. Silver Eagles have seen a spike in price in recent years, which has caused some investors to think twice about buying them.

Silver Eagles are an excellent choice for silver bullion investment, but there are several other exceptional options available. A popular alternative to bullion coins is silver bars.

Why Are Silver Eagles More Expensive?

Over the past two years, Silver Eagle collectors have been hit hard with rising premiums. Unfortunately, these high premiums are expected to remain through 2023. As the demand for Eagles skyrockets in 2022, the U.S. Mint has made a strategic move to produce fewer coins than usual – and there is a good reason behind this decision.

The U.S. Mint has been directed by the government to procure blanks or planchets from an approved third-party provider. The Mint quickly realized that manufacturing these items internally was not a viable financial option so they now must purchase them from other mints at a set cost.

Since Silver Eagle demand has its ups and downs the U.S. Mint has restructured its operations so that they are more efficient and save money. Outsourcing silver blank manufacturing was deemed the most cost-effective approach. The U.S. Mint entered into long-term agreements with select suppliers, offering fixed prices for the necessary blanks.

When demand is high, it can be difficult for suppliers to bind themselves to a long-term agreement when they can earn more money selling silver elsewhere. Signing on with the Mint might mean they lose out on potential profits they could make elsewhere. With difficult-to-meet requirements and economic incentives to sell silver elsewhere for higher profit, sourcing additional suppliers have been challenging for those in charge of the silver Eagle program. There is only one supplier of silver blanks for silver Eagles today, compounding the problem.

We expect supply challenges to persist through 2023 for the American Silver Eagle program. Eagles dated 2023 are likely to be more valuable because of their scarcity. As the years pass by, it will be more and more difficult to get your hands on a 2023 Eagle. This could be an excellent time to purchase Eagles from the years the Mint is on allocation despite our expectation that premiums will remain high. High premiums may be a non-starter for value-oriented investors or stackers. If you are looking for the best bang for your buck, there are other more affordable silver investment options to consider.

How Silver Bars Compare to Silver Eagles

Silver bars are ideal for investors who want to buy as much silver as their budget allows because they offer the lowest premium over spot. In addition, these rectangle-shaped metals can be easily stacked and stored away with ease.

Silver bars are very different from Silver Eagles in several ways. For one, they are valued and priced at only their silver value, whereas Eagles face government markups since they’re government-backed. Silver Eagles are only produced by the U.S. Mint, while silver bars are produced by any mint, private and otherwise. This makes them more widely available than the high-demand Eagles. This carries the same caveat that comes with buying a Silver Buffalo. Although silver bars are easy to find, they do not have the same guaranteed level of quality that government-minted bullion has.

Fortunately, silver bars can be bought from various reputable retailers and dealers. Silver bars come in many different sizes, including 1 oz, 5 oz, 10 oz, 1 kilo, 100 oz, and more. It is also easy to find silver bars in fractional sizes so that investors can get the precise amount of silver they are looking for.

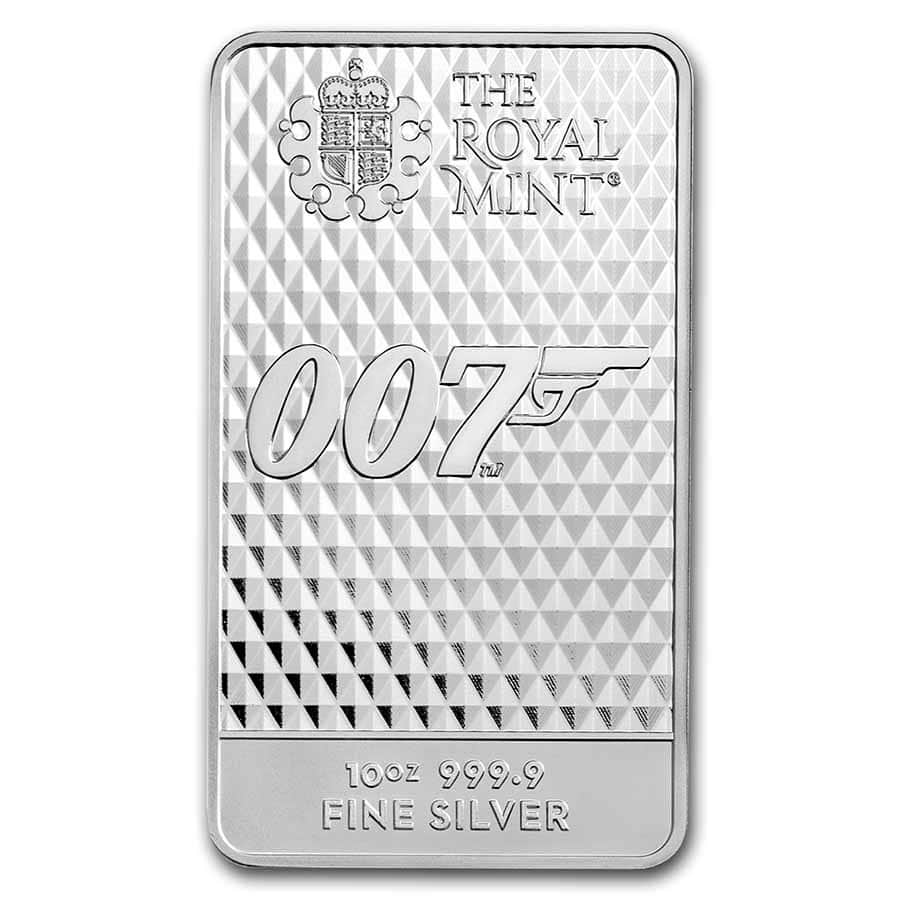

Most silver bars tend to have a generic look and feel but some investors seek something with a bit more flair. There are art bars available for those who want more visual appeal. They display intricate designs that range from simple shapes and symbols to elaborate works of art.

A popular example is this Cast Poured Silver Bar, which combines a unique, branded design with the added charm of being cast poured as opposed to minted.

The value of these bars depends on the amount of silver and the desirability or collectability of the design. These bars can be more expensive than generic silver bars.

Price Differences

A regular 1 oz silver bar is almost always priced at or within a few dollars of the spot price. Bars have very low premiums, especially when compared to Silver Eagles. At the time of this writing on average a 1 oz silver bar is priced $8 less than a Silver Eagle.

Keep in mind that silver rates change based on current market conditions, so prices represent what is happening in the silver trading industry. Trends can change quickly so always be sure to have an eye on the spot price on the day you want to invest.

Another way to purchase silver bullion products inexpensively is to look for trusted secondary market sellers. For example, APMEX offers secondary market 100 oz silver bars. This helps keep the cost down if you don’t mind purchasing a bar that someone else has owned previously.

Key Takeaways

Silver bars make a great alternative to Silver Eagles if your main priority is buying the largest amount of silver at the lowest cost. They are made by many mints and are widely available.

These bullion products are available in numerous sizes so that investors can get the exact amount of silver they want. While silver bars are valued solely on their silver content, some have more collectible value because of their eye-catching designs. If art bars interest you, then there are plenty to choose from, note that they will likely be more expensive than a plain silver bar.