What is the Chicago Mercantile Exchange (CME)?

The Chicago Mercantile Exchange (CME) is a leading financial exchange that facilitates trading various financial instruments, including futures and options contracts.

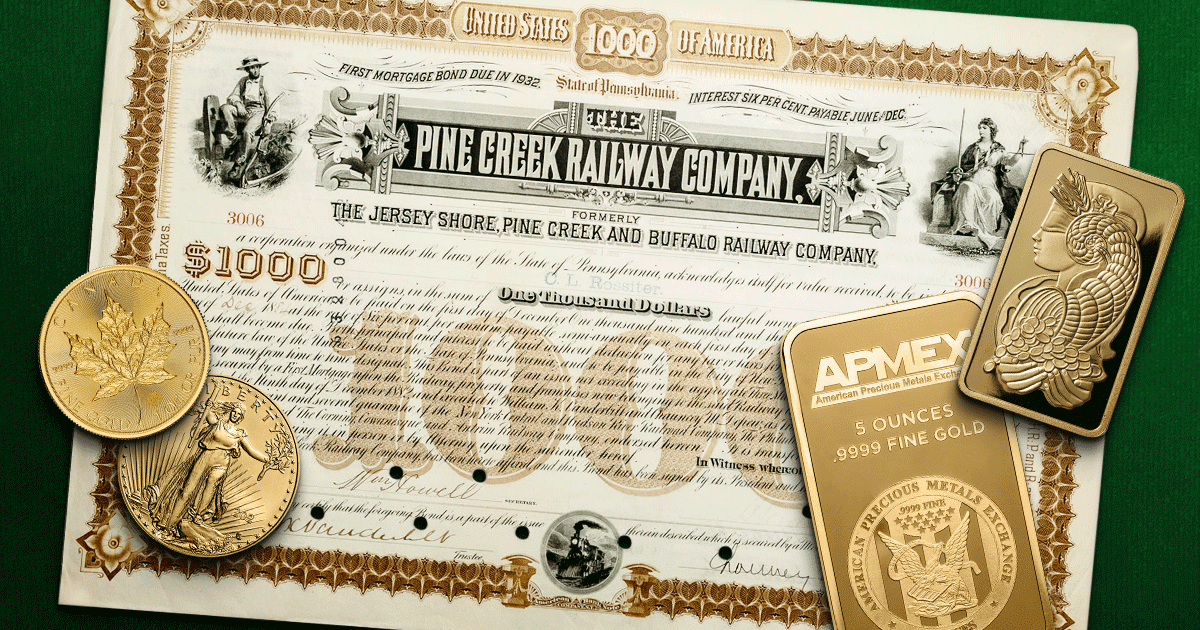

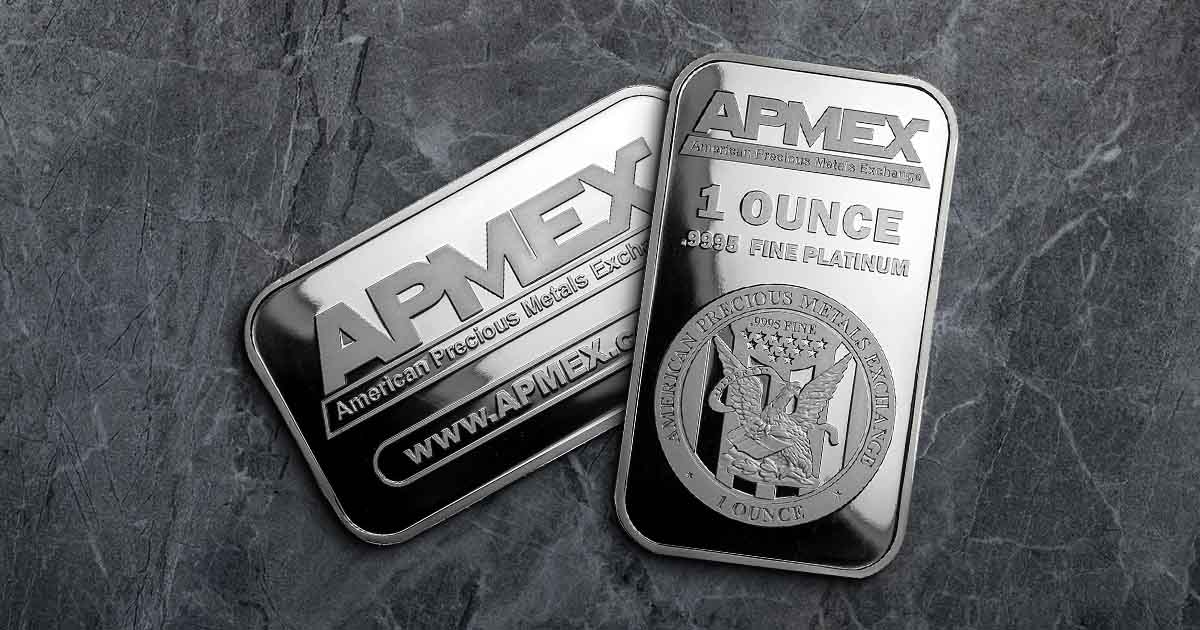

Learn the benefits and basic steps to investing in Precious Metals with our Investing Guides for beginners, including How-To guides for investing in Gold, Silver, Platinum, and Palladium.

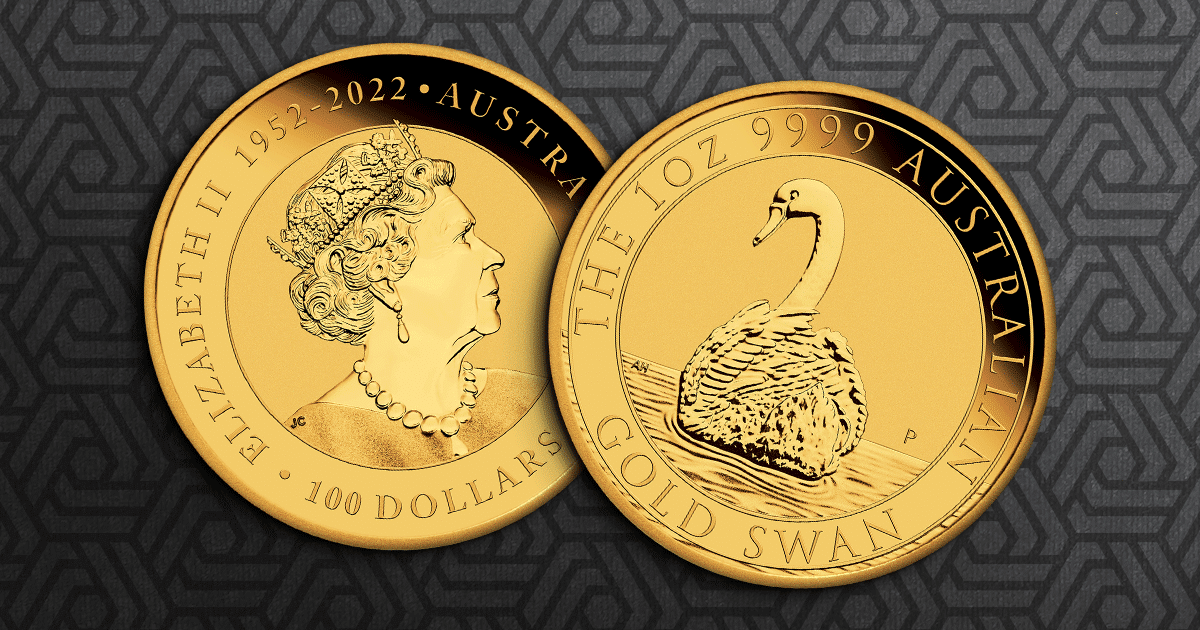

Gold, Silver, Platinum, and Palladium all come in various forms and sizes to create a variety of options for investors and collectors.

Since the U.S. Mint’s American Eagle program began in 1986, Gold and Silver Eagles have remained a popular choice among both investors and collectors