Gold investing has long been a cornerstone of financial portfolios across the globe. It is known for its stability and ability to hedge against inflation and economic uncertainty, making it a favored choice among investors. Whether in the form of coins, bars, or ETFs (Exchange Traded Funds), gold’s allure lies in its potential for capital appreciation and its physical and enduring nature. When choosing between cast and minted gold bars, it is essential to understand their differences to make informed investment decisions.

What are Cast Gold Bars?

Cast gold bars are a traditional form of gold bullion, valued for investment and collection. These bars are created through a casting process, which involves melting gold and pouring it into molds. The process is simple and has been used for centuries, linking cast bars to the historical methods of gold processing.

Appearance

The appearance of cast bars is distinct. They typically have a rugged, rustic look with a slightly irregular shape and texture, giving each bar a unique character. The surface may show pour lines or slight imperfections, which are a natural result of the casting process and are often considered part of the bar’s charm.

Purity

Cast gold bars are usually 99.99% pure, though this can vary slightly. They come in many sizes, ranging from small bars of just a few grams to large bars weighing several kilograms. The weight and purity are usually stamped directly into the gold bar, the refiner’s mark, and sometimes a serial number.

Who Buys Cast Bars?

Cast gold bars are often favored by investors who appreciate the raw and unrefined aesthetic, and they usually carry a lower premium over the spot price of gold compared to minted bars. This makes them a cost-effective option for investing in physical gold, particularly in larger quantities.

What are Minted Gold Bars?

Minted gold bars represent a more refined and precise form of gold bullion, offering a sleek and polished alternative to the rustic charm of cast gold bars. These bars are produced through a meticulous minting process. The blank is struck under high pressure between dies to imprint detailed designs, logos, and inscriptions.

Appearance

The appearance of minted gold bars is characterized by their smooth, even surfaces and sharp edges. They often feature intricate designs or patterns, along with the bar’s weight, purity, and the mint’s mark, all presented with high craftsmanship. This precision and aesthetic appeal make minted gold bars attractive to investors and collectors.

Purity

These bars are typically made of 99.99% pure gold, often denoted as .9999 fineness. Minted gold bars are available in a range of sizes, like cast bars, but are more commonly found in smaller denominations. Added security features may include serial numbers, assay cards, and tamper-evident packaging.

Who Buys Minted Gold Bars?

Minted gold bars are available in a range of sizes, like cast bars, but are more commonly found in smaller denominations. This makes them accessible to a broader range of investors, from those just starting in gold investment to seasoned collectors. The smaller sizes also offer greater flexibility for liquidation as they can be sold in parts, rather than having to liquidate a larger investment at once.

Cast Gold Bars vs Minted Gold Bars Summarized

| Cast Gold Bars | Minted Gold Bars | |

| Purity | .9999 | .9999 |

| Appearance | Rustic | Detailed |

| Cost | Often Lower than Minted | Often More than Cast |

| Investors | Leans Towards Bullion Buyers | Aesthetic and Bullion Value |

| Liquidity | Large Bars may be Harder to Sell | Fractional Sizes Highly Liquid |

Popular Cast Gold Bars

Cast gold bars are popular among investors and collectors for their traditional appeal and lower premiums over spot gold prices. Some of the most renowned and widely recognized cast gold bars in the market include:

PAMP Suisse Cast Gold Bars

PAMP Suisse is one of the world’s most prestigious precious metals refineries based in Switzerland. Their cast gold bars are highly sought after for their quality and purity, typically .9999 fine gold. These bars come in a variety of sizes, ranging from small to large bullion, making them suitable for different investment scales.

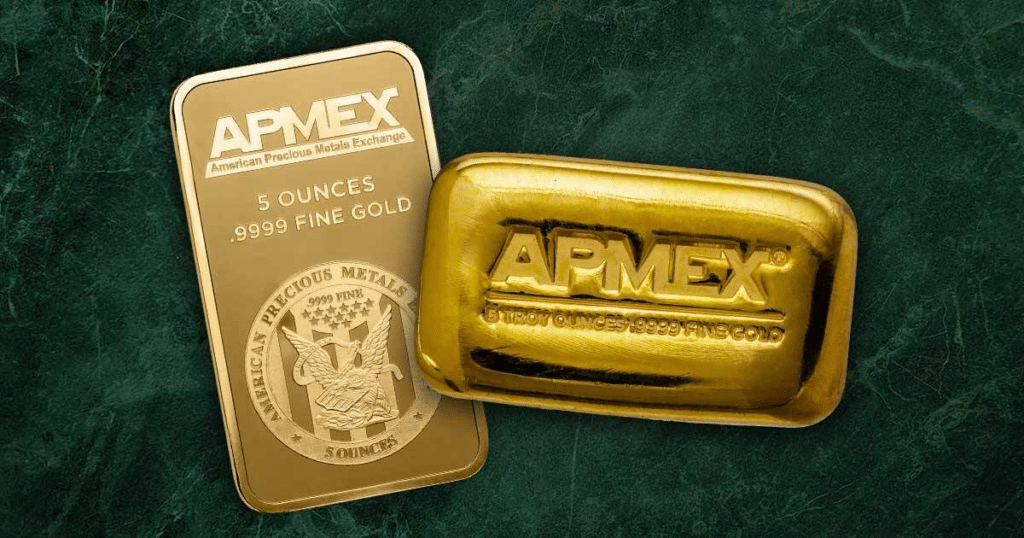

APMEX Cast Gold Bars

We provide cast bars in assorted sizes to suit different investment needs and budgets, ranging from small bars like 50 grams to larger options like 1 kilogram gold bars. Many of the cast gold bars sold through APMEX come with an assay certificate providing additional assurance of their authenticity and quality.

Perth Mint Cast Gold Bars

The Perth Mint in Australia is one of the oldest mints in operation today and is highly respected for its quality products. Their cast gold bars are known for their purity and craftsmanship, available in a range of sizes to suit various investment needs.

Valcambi Cast Gold Bars

Valcambi, a mint based in Switzerland, produces high-quality cast gold bars that are popular among global investors. These bars are known for their sleek design and high gold purity, available in many sizes from small to large bars.

Popular Gold Minted Bars

Minted gold bars are highly sought after by investors and collectors due to their precision, craftsmanship, and aesthetic appeal. Some of the most popular minted gold bars in the market are:

PAMP Suisse Fortuna Bars

PAMP Suisse, based in Switzerland, is renowned for its high-quality gold products. The Fortuna series is particularly popular, featuring the Roman goddess of fortune on the obverse. These bars are known for their artistic design, high purity (.9999 fine gold), and come in a variety of sizes.

APMEX Minted Gold Bars

Catering to a wide range of investment needs, we offer minted gold bars in assorted sizes, from 1 gram to larger bars like 1 kilogram. This variety allows investors to choose bars that fit their budget and investment strategy. Our bars feature intricate designs and polished finishes, making them attractive for collectors and investors.

Royal Canadian Mint (RCM) Gold Bars

The RCM is known for its commitment to quality and purity. Their minted gold bars are .9999 fine and often feature unique serial numbers for added security. The RCM bars are highly regarded in the international market for their reliability and purity.

Perth Mint Gold Bars

The Perth Mint in Australia produces a range of beautifully designed minted gold bars. These bars are known for their .9999 purity and often come in tamper-evident packaging with a unique serial number and assay card verifying the bar’s details.

Whether you choose cast or minted gold bars from a reputable dealer, each type offers its unique appeal and advantages. Cast gold bars, with their rustic charm and typically lower premiums, are ideal for investors focused on value and bulk investment in gold. Minted gold bars offer the allure of intricate designs, high purity, and enhanced security features, appealing to investors and collectors who value aesthetics and detailed craftsmanship.

As you might expect, cast bars are not just limited to gold. Both silver and copper are other metals that cast bars are commonly made with. One of our more popular non-gold options is the Silver Cast Bar from Pioneer Metals.

The choice depends on personal investment goals, preferences for liquidity and design, and the balance you wish to achieve in your precious metals portfolio.