Silver American Eagles are popular bullion coins to invest in. These coins are easily recognized and backed by the U.S. government, making them great bullion to purchase. However, the price of Silver Eagles has increased in 2022 and has made some buyers reconsider investing for fear of losing out when they sell their Eagle later.

Fortunately, there are many other silver bullion options that come from reputable mints and are similar to Silver Eagles. A popular alternative is the stunning Silver Canadian Maple Leaf.

Why Are Silver Eagles More Expensive?

Die-hard fans of Silver Eagles have suffered through premium increases over the past two years. Heading into 2023, the outlook does not look much better. The U.S. Mint is expected to mint fewer Eagles than they did in 2022, when demand far outstripped supply. This might seem illogical, but there’s a very good reason for it.

The U.S. Mint does not manufacture their own blanks in-house, but instead must buy blanks from a third party at a government-mandated price. Decades ago, the U.S. Mint would manufacture their own blanks (or planchets) but found it cost-prohibitive to maintain the operation. With demand for Silver Eagles fluctuating each year, the U.S. Mint found they could not maintain the personnel and equipment in low demand years. Outsourcing the manufacture of silver blanks was determined to be the most cost-effective option. Suppliers signed a long-term contract with fixed prices and some wiggle room to handle normal swings in demand.

Signing additional long-term contracts during peak demand when suppliers can make more money elsewhere is difficult to say the least. Suppliers are incentivized financially to get the best price possible for a scarce commodity. Striking a deal with the Mint now would be leaving money on the table.

The Sunshine Mint is the United States Mint’s only supplier for blanks. Sunshine Mint is more inclined to sell its silver to other buyers, as it can profit more with each sale. Additionally, because of government pricing regulations, the Mint has little wiggle room to negotiate costs. Although Sunshine Mint could choose to send a greater portion of its supplies to the U.S. Mint, it would be at its own expense. This means the U.S. Mint is on allocation, which is like a budget for silver supplies. They have fewer blanks to strike and can offer fewer Silver Eagle coins.

The one bright spot on expecting a lower quantity of Silver Eagles minted for 2023 is that scarcity rhymes with rarity. And we all love rarity in coins. If you’re a collector of PCGS-graded Silver Eagles, 2023 will be a good year to acquire more and add to your assortment. In future years to come, it will be more difficult to acquire a 2023 Eagle, which may drive the premiums up.

How Silver Maple Leafs Compare to Silver Eagles

Silver Maples and Silver Eagles contain one troy ounce of silver respectively and have worldwide recognition. Despite their key similarities, there are notable differences that are important for investors to consider.

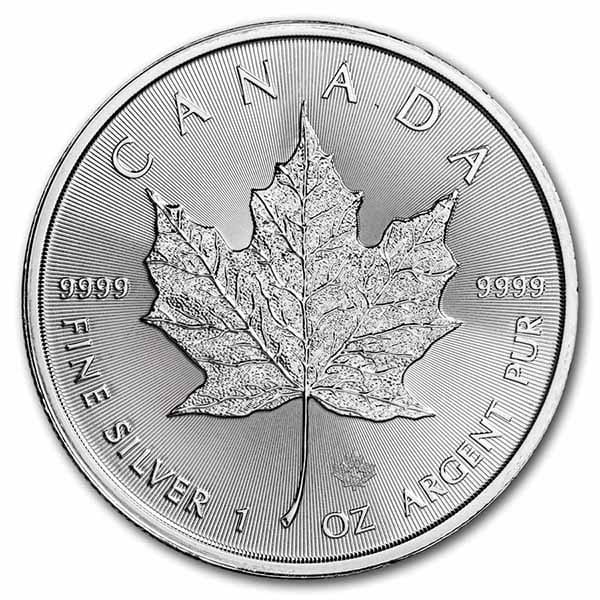

These coins are easy to liquidate and typically have lower premiums than Silver Eagles, making Maples good investments to buy and sell quickly when needed. Silver Maples also have security features that Silver Eagles do not. For example, there is a laser-engraved security mark on Maple Leafs dated 2015 to present. If you examine this maple leaf mark under magnification and see a two-dimensional design, then it is legit. However, if the mark appears three-dimensional it is a fake.

The Royal Canadian Mint has also created a radial line background on each Maple that produces a unique pattern that diffracts light. Many counterfeit Maples have thicker lines that are spaced wider apart and do not refract light the same way. These security measures provide peace of mind that buyers get what they pay for, making it easier to sell on the secondary market.

The Royal Canadian Mint developed MintShield™ technology to reduce milk spotting on Silver Maples. Every Maple produced after 2018 benefits from MintShield™, ensuring that they remain as spot-free as possible. This technology is exclusive to the RCM and there is no other process like it in the world.

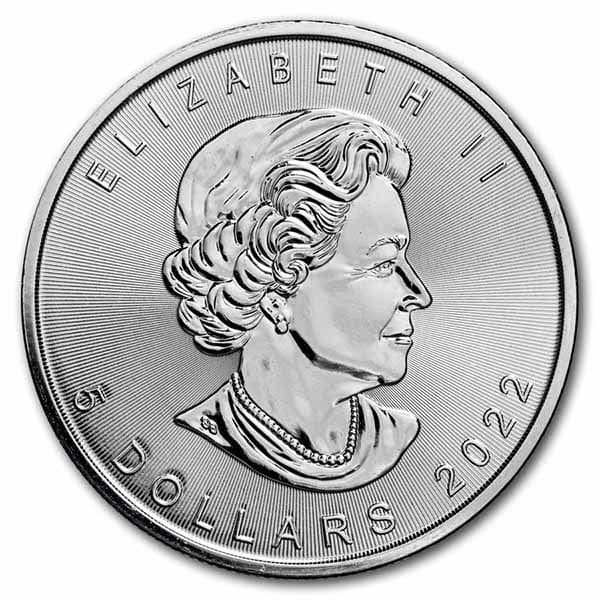

For those interested in coin design, Silver Maple Leafs features a beautiful, incredibly detailed maple leaf on the reverse and the British king or queen on the obverse. The reverse’s maple leaf is a breathtaking work of art closely resembling a real maple leaf. The crisply detailed maple leaf design has become iconic and is beloved by many in the silver community.

Silver Maples have a purity of 99.99% whereas Silver Eagles are 99.9%, so if purity matters more to an investor this is a difference to consider. Coins made with .9999 fine silver are often commemorative coins of limited mintages. It’s rare to find a bullion coin from a sovereign mint with this level of purity.

Although we don’t consider face value an important feature on a silver coin, eagle-eyed silverbugs may notice the Silver Maple has a face value of $5. The Silver Eagle carries a face value of $1. As both contain 1 troy ounce of silver, we feel this is more of a curiosity than anything else.

And lastly, for the discerning collector, both have certified and proof options available for purchase. Some collectors of American Silver Eagles have attempted to obtain certified coins of every year, and the same could be done for Silver Maples.

Price Differences

Silver Maples have consistently had lower premiums than Silver Eagles. This could make Maples a better investment in the long run since they are cheaper to acquire than Eagles and are also easy to sell when the time comes.

Silver Eagles premiums can be $10-$15 or more over spot, due to the reasons listed above. Supply and demand are a key factor driving these premiums. At the time of writing this article, $10 over spot for Silver Eagles would be considered an excellent sale price. Silver Maples premiums tend to be lower, commonly found around $8 over spot at the time of writing. Silver Maples are more often on sale as well, which can take a dollar or two off the premium.

Silver is a commodity with prices changing throughout the day based on available supply and demand. While these prices listed are an accurate depiction of current market rates at the time of writing, it’s possible conditions will have changed at the time of reading.

Key Takeaways

With the U.S. Mint on allocation and no remedy to its silver shortage in sight, finding other silver bullion to invest in could be a smart move. Silver Maple Leafs are solid alternatives to Silver Eagles because they are government-backed sovereign coins recognized worldwide with reasonable premiums. They have security features that Eagles do not, are made with exclusive milk spot-reducing technology, and have high liquidity. The quality of this coin is excellent, and holders often remark on its beauty.

During this time of spiking Silver Eagle prices, it may be wise to consider other options. For investors who only buy American silver, the Canadian Silver Maples will not be a great fit. That investor may consider buying from U.S.-based private mints or iconic silver rounds like the Silver Buffalo. However, if investors are open to bullion from other countries, Silver Maples are a great alternative to the iconic American Silver Eagle.

For investors seeking to diversify their portfolios, both the 1 oz Maple Leaf and the 1 oz Eagle come in gold versions as well. These options are similar to their silver counterparts and also offer high liquidity due to their popularity in the marketplace.