Silver American Eagles are an excellent choice for those investing in silver bullion coins. This coin is a popular option because it is recognized worldwide and is guaranteed by the United States government. Silver Eagle premiums remained high in 2022, which made some investors reconsider Silver Eagles.

Fortunately, there are numerous other outstanding alternatives to Silver Eagles to consider. A well-known option is the Silver Krugerrands.

Why Are Silver Eagles More Expensive?

Over the last two years, Silver Eagle enthusiasts have weathered steep premium increases. Despite soaring Silver Eagle demand, the U.S. Mint is producing fewer coins. While this seems counterintuitive, there is a good explanation for this.

The United States Mint acquires silver blanks (typically called planchets) from a third-party vendor at an agreed-upon price using fixed, long-term contracts. The U.S. Mint outsources their entire blank production for the silver eagle program to avoid incurring high overhead costs during periods of low demand.

Fewer suppliers are willing or able to commit to the U.S. Mint during periods of higher demand when they could make more money elsewhere for less effort. The U.S. Mint has strict quality standards and requirements for mints who produce their blanks that can be expensive or difficult to meet. The Sunshine Mint is currently the only provider of blanks to the United States Mint. With a limited supply and only one supplier, the U.S. Mint will be remaining on allocation through 2023, unless something changes in the near term.

There will likely be a production shortage in 2023, which could present an excellent opportunity to capitalize on the scarcity and rarity of the 2023 silver eagle coins. If you’re interested in growing your collection of graded bullion coins, 2023 will be an excellent year to buy PCGS-graded Silver Eagles.

How Silver Krugerrands Compare to Silver Eagles

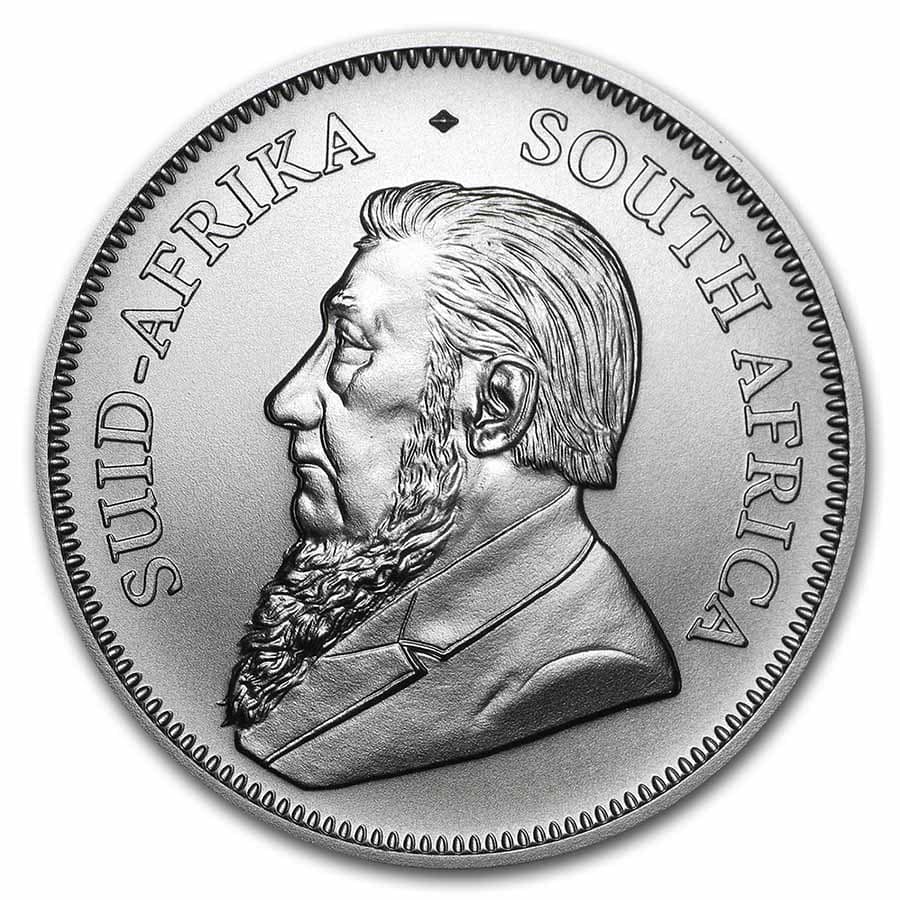

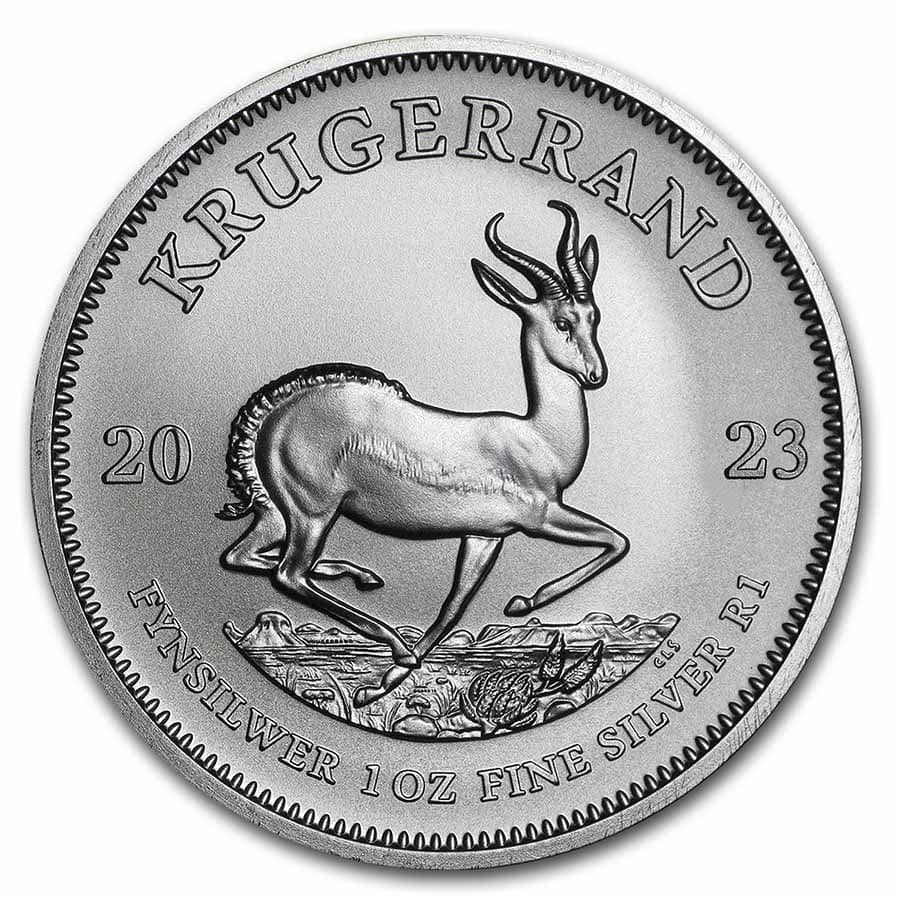

The Krugerrand bullion coin is a product from the South African Mint. The Silver Krugerrand design is taken from the wildly popular Gold Krugerrand coin that was first minted in 1967. The first Silver Krugerrand coin was launched in 2017.

Silver Krugerrands and Silver Eagles both have one troy ounce of .999 fine silver and are legal tender in their respective countries. Both bullion coins are backed by recognizable government mints, guaranteeing quality and peace of mind.

The Silver Krugerrand’s obverse depicts Paul Kruger, a prominent South African president, and “South Africa” in Afrikaans and English. The reverse shows the country’s national animal, the springbok antelope, and its weight and year. A difference between these two coins is that Krugerrands do not display fineness on the reverse as Eagles do.

Silver Krugerrands are easy to buy and sell because of their government-backing and recognizable name. These coins have a notable security feature that guarantees a coin’s legitimacy. Upon closer inspection, the word “Krugerrand” can be seen in micro text in the mountains behind the antelope underneath its hoofs. It is likely a fake if you find a Silver Krugerrand without this micro text.

Price Differences

Like other bullion coins from government mints, the Silver Krugerrand does have government markups, but it still has a much lower premium than a Silver Eagle.

Silver prices are subject to fluctuations in the current markets, and these assessments represent what is happening now. It is important to remember that conditions can change rapidly, so you should be aware of the market before investing any funds.

There is no shortage of Silver Krugerrands as there has been with Silver Eagles, so you should expect the premiums to continue to be lower in the near term.

Key Takeaways

As the U.S. Mint struggles to meet silver demand, looking for other sources of bullion might be a wise move in 2023. Silver Krugerrands are an ideal substitute for Silver Eagles because they contain the same amount of silver, plus government mint assurance. Krugerrands have lower premiums than Eagles, are widely available and easy to liquidate, and have a security feature to ensure legitimacy.

This South African coin may appeal less to investors and stackers who prefer coins from their home countries.