Investors diversify their portfolios by investing in a broad spectrum of assets, such as physical gold or Bitcoin. One is a tangible asset with a rich history, while the other is a digital currency that has taken the financial world by storm. How do these two distinct forms of investment compare, particularly regarding their prices?

In this article, we will highlight physical gold value vs bitcoin value, explore how each has evolved, and discover what drives their market value.

Understanding Physical Gold

Gold has been a symbol of wealth and a store of value for millennia. Its allure stems from its physical properties: rarity, durability, and the intrinsic beauty that has made it a coveted material for jewelry and currency. The price of physical gold reflects its physical demand and is a barometer of economic stability.

Several factors play a pivotal role in influencing the prices of physical gold. Economic uncertainty often leads investors to gold as a ‘safe haven’ asset. During inflation, currency devaluation, or stock market volatility, gold prices tend to rise as it is seen as a stable store of value. When the economy is robust, gold prices may stagnate or decline as investors seek higher returns elsewhere.

Geopolitical tensions and crises can also lead to spikes in gold prices. Gold is considered a safe investment during political instability, as its value is not directly tied to any country’s economy or political system. Additionally, the balance between supply and demand significantly impacts physical gold prices. Gold mining and production rates, central bank policies, and even technological advancements in gold extraction and processing can affect the supply side, influencing the market price.

Understanding Bitcoin

Bitcoin is a relatively new asset, born in the digital era. Introduced in 2009 by an anonymous entity known as Satoshi Nakamoto, Bitcoin is the first and most well-known cryptocurrency. It is a decentralized digital currency that operates on a peer-to-peer network, allowing users to send and receive payments without the need for intermediaries like banks. Bitcoin relies on blockchain technology to record transactions securely and transparently. With a limited supply capped at 21 million coins, Bitcoin is often referred to as “digital gold” and is known for its volatility, speculative nature, and potential as both a medium of exchange and a store of value. Its appeal lies in its decentralization, digital scarcity, and potential as both a medium of exchange and a store of value.

The factors influencing Bitcoin prices are different from those affecting physical gold. One of the most significant drivers is market demand, fueled by public sentiment and investor interest. As more people learn about and use Bitcoin, its price increases. Media coverage, public endorsements, and the perceived utility of Bitcoin as a digital currency often drive this demand.

Technological advancements and regulatory developments also significantly impact Bitcoin prices. Innovations that enhance the security, usability, or scalability of Bitcoin can boost investor confidence, driving up prices. Conversely, regulatory news, such as government crackdowns or restrictions on cryptocurrency use, can lead to price drops due to fear of reduced adoption or legal challenges.

Unlike gold, Bitcoin exhibits high volatility. Its price can fluctuate wildly based on market sentiment, news events, and changes in the cryptocurrency ecosystem. This volatility is partly due to Bitcoin’s relatively small market size compared to traditional assets like gold, making it more susceptible to large trades or news events.

Bitcoin prices reflect the evolving landscape of digital currencies, investor sentiment, and the balance between regulatory challenges and technological advancements. Understanding these dynamics is crucial if you are considering investing in Bitcoin.

Price Trends Over Time

Comparing the price trends of physical gold vs Bitcoin offers insights into their respective market behaviors and investment profiles. While gold has a long history of relatively stable value appreciation, Bitcoin is known for its rapid price changes and high volatility.

Gold

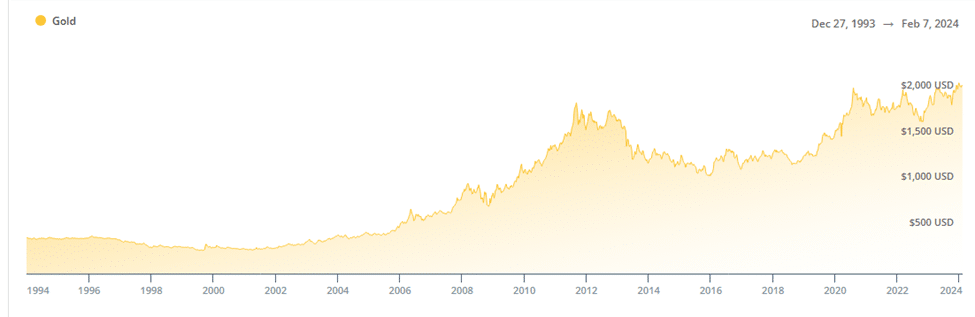

Historically, physical gold prices have shown a gradual and steady increase over decades, punctuated by sharp rises during economic distress or geopolitical turmoil. For instance, gold prices significantly increased during the financial crisis of 2008 and amidst global uncertainties like the Eurozone crisis. Gold hit its all-time high in December 2023, reaching over $2,100. Since then, it has only decreased slightly and stayed steady above $2,000. This steady growth reflects gold’s reputation as a safe haven during economic instability.

Bitcoin

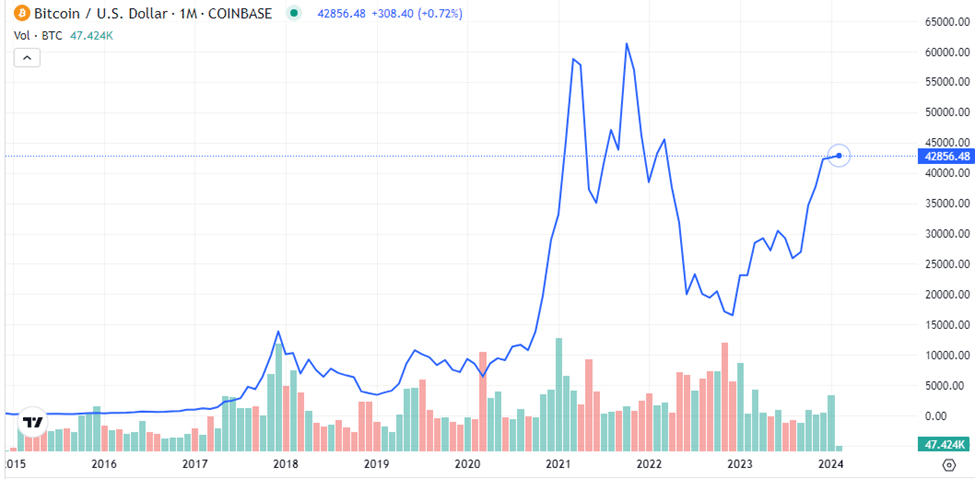

Bitcoin’s price history is marked by rapid, dramatic increases and sharp declines. Since its inception, Bitcoin has experienced several boom-and-bust cycles. Notable surges in Bitcoin prices occurred in late 2013, 2017, and again in 2020, followed by significant drops. Its all-time high is around $65,000 per Bitcoin in November of 2021. While it is on the rise again, in early 2023, it dipped significantly, reaching prices almost as low as $15,000. These fluctuations are attributed to investor speculation, regulatory news, and technological developments within the cryptocurrency space.

The volatility of Bitcoin prices contrasts starkly with the more stable progression of gold prices. While gold is often used as a hedge against inflation and economic uncertainty, Bitcoin is viewed by many as a speculative investment with potential for high returns, accompanied by a higher risk profile.

Both assets can be valuable additions to a diversified investment portfolio, but their roles and the nature of their price movements are fundamentally different. Investors should consider these differences, risk tolerance, and investment time horizon when deciding how to allocate investments between physical gold and Bitcoin.

Investment Perspectives

When considering physical gold vs Bitcoin for investment, it is essential to understand how each fit into an overall investment strategy.

Diversification and Risk Management

- Physical gold has traditionally been a popular choice for diversification. Its price generally doesn’t move in tandem with stock markets, making it a valuable asset during times of economic downturn or stock market turbulence. Gold’s tangible nature and finite supply also contribute to its perception as a reliable store of value.

- While also used for diversification, Bitcoin represents a different kind of asset. Its digital nature and underlying blockchain technology offer a unique proposition in the financial world. However, its high price volatility introduces a significant risk factor.

Long-term vs. Short-term Investment

- Gold’s long-term value has been relatively stable and increasing, making it a suitable choice for long-term investment. Its history as a store of value and hedge against inflation contributes to this perspective.

- Bitcoin, in contrast, is often viewed through a shorter-term lens due to its volatility and relatively short history. While some investors hold Bitcoin for long-term speculative reasons, believing in its potential as ‘digital gold,’ others trade it in the short term to capitalize on its price fluctuations.

Physical gold and Bitcoin prices each offer unique opportunities and challenges for investors. Gold is a stable, long-term investment, while Bitcoin offers a more speculative, high-risk, high-reward option. Investors should weigh these factors, considering their risk tolerance, investment goals, and time horizons.

Outlook

The future of physical gold and Bitcoin prices is a topic of much debate among investors and financial analysts. While predictions are always speculative, understanding potential trends and influencing factors can help investors make informed decisions.

Physical Gold: The outlook for gold often hinges on global economic trends, monetary policies, and geopolitical stability. Experts predict that gold will continue to play its role as a safe haven asset. In scenarios of increased inflation, economic downturns, or political instability, gold prices are likely to rise as investors seek stability. With limited new gold mining opportunities, a constrained supply could also contribute to steady or increased gold prices over time.

Bitcoin: Its future is more uncertain, given its relatively brief history and the evolving nature of the cryptocurrency market. Technological advancements, regulatory changes, and broader adoption in the financial sector will significantly influence Bitcoin’s future. Some experts predict that Bitcoin could become a mainstream financial asset and see widespread adoption, potentially leading to price stabilization and growth. However, this is contingent on overcoming regulatory hurdles, achieving technological improvements, and gaining investor confidence.

Market dynamics, investor sentiment, and global economic factors will continue to shape physical gold prices vs Bitcoin prices. While gold is expected to maintain its steady course, Bitcoin’s journey might be more tumultuous.